Below, @chanho and I analyze https://dao.curve.fi/vote/parameter/45, which proposes to reduce FRAX-BP fees to 1bps and increase A for 4 FRAX-BP metapools: sUSD (200->500), gusd(200->1500), busd(200->1500), tusd(200->700)

-Summary-

Simulations suggest that the proposed parameter changes are likely too extreme. While 3pool and its metapools may provide approximate guidance, parameter selection for FRAX-BP and its metapools must take into consideration the TVL, volume, volatility, and (limited) historical data of the specific pools in question.

Below we examine the proposed fee reduction and amplitude (A) parameter changes individually. We find that the proposed fee reduction may make FRAX-BP more competitive, but is likely more extreme than is warranted. In particular, the fee reduction is unlikely to generate sufficient increases in volume to counteract revenue losses due to reduced fees.

Our simulation results suggest that the proposed A increases appear uniformly too high, with the potential exception of the GUSD-FRAXBP pool. Generally, the proposed A values are above where returns are expected to saturate, potentially exposing LPs to unnecessary risk due to pool imbalance or depegging.

-Fee Reduction from 4 bps to 1 bps-

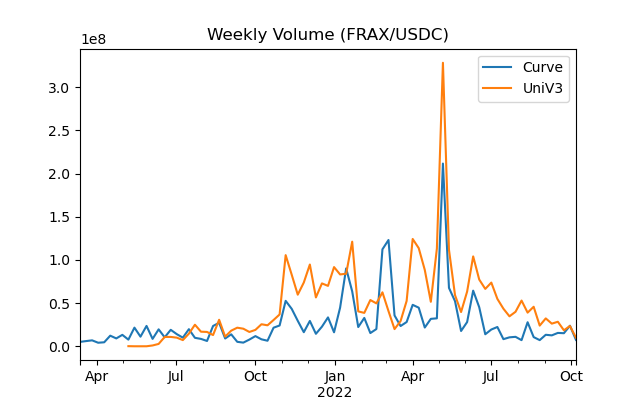

Reducing fees can increase revenue by increasing volume to the basepool, and/or by reducing spreads in metapools. Comparing FRAX-BP to its primary competitors (Uniswap v3 FRAX-USDC pools), we find that Uniswap volume across fee tiers is ~2x that of FRAX-BP.

This suggests that FRAX-BP could plausibly take some volume from competitors by reducing fees to a more competitive rate. However, even if all historical volume was redirected to FRAX-BP, a 4x reduction in fees would still result in an overall reduction in revenue. Therefore, it may make more sense to implement a more modest fee reduction.

Moreover, our arbitrage simulations suggest that reducing fees would not increase metapool volume to compensate for reduced revenues, as we saw with 3pool, and would in fact lead to lower returns for the metapools (see simulation results below for further details). We note, however, that this type of simulation may underestimate potential volume increases, so we are currently developing simulations that explicitly incorporate competition across AMMs.

-A Parameter Changes-

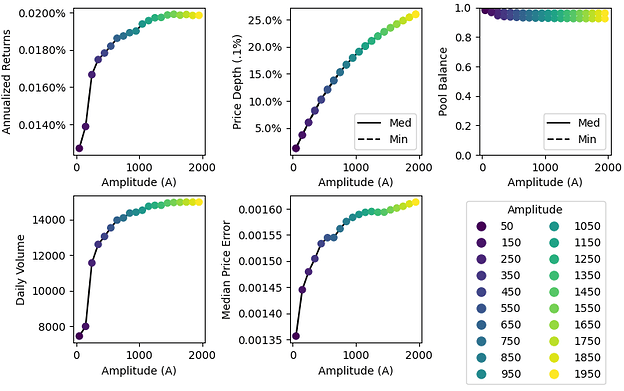

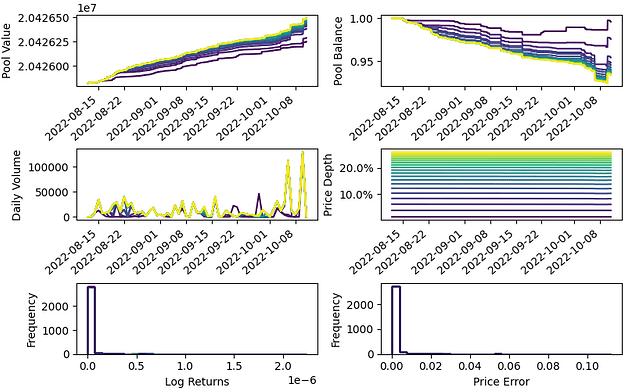

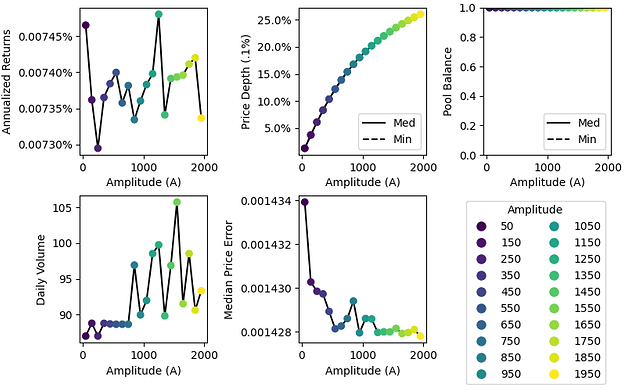

Generally, our simulations suggest that the proposed A parameters are too high, and may introduce unnecessary risk for little additional reward. In particular, we emphasize that the proposed A parameter for sUSD-FRAXBP (A=500) is far too high, and should be reduced to 50-100 (consistent with susdv2 pool).

sUSD-FRAXBP

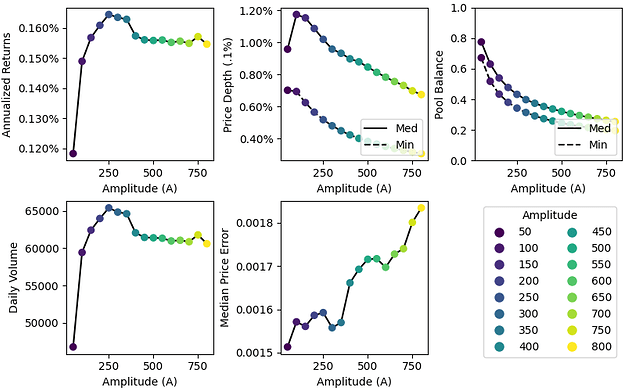

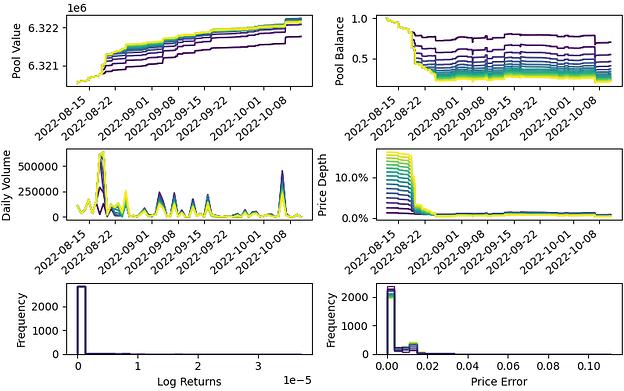

Both sUSD pools are historically greatly imbalanced due to sUSD supply and usage. Increasing A could increase LP risk substantially due to further imbalance, and we would warn against any such increase. Consistent with this interpretation, our simulations suggest that arbitrage to prevailing prices would lead to extreme imbalance if A is much higher than 50-100. Typically, we target a balance metric >.8, which corresponds to 60/40 balance in a pool with 2 coins.

Moreover, as crypto risk team’s recent assessment on Synthetix atomic swaps detailed, pool parameters for SNX synths must be carefully calibrated in accordance with Synthetix parameters. This is not only because Gauntlet’s simulations rely on current pool parameters, but slippage in synth pools act as a brake on toxic arbitrage flow through atomic swaps.

sUSD Simulation Results: 4 bps Basepool

sUSD Simulation Results: 1 bps Basepool

GUSD-FRAXBP

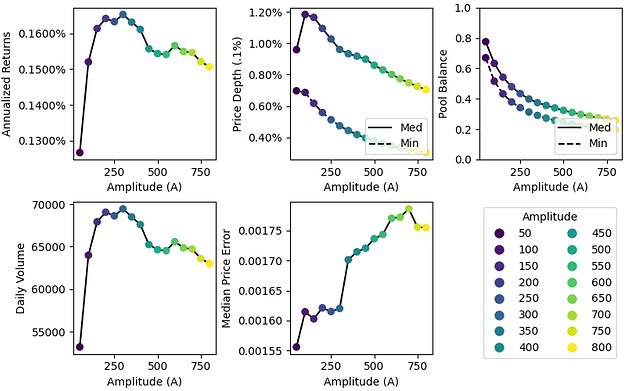

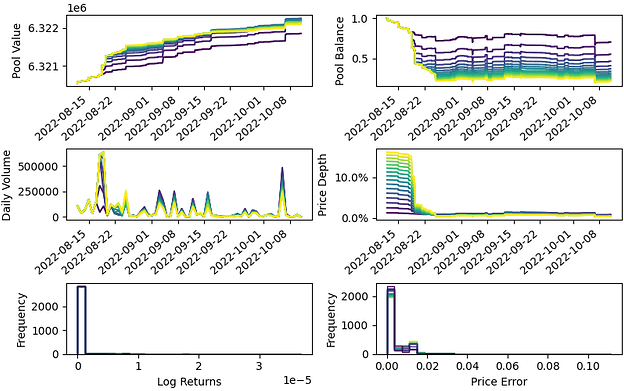

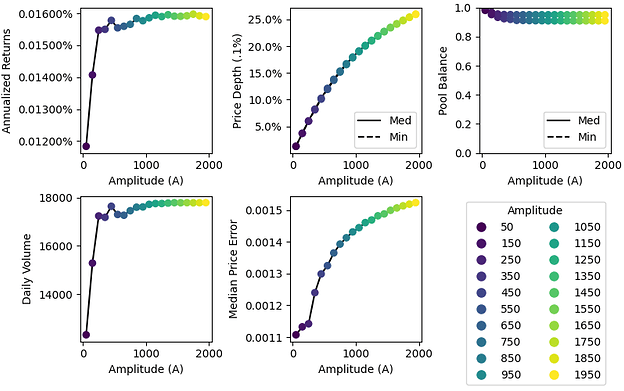

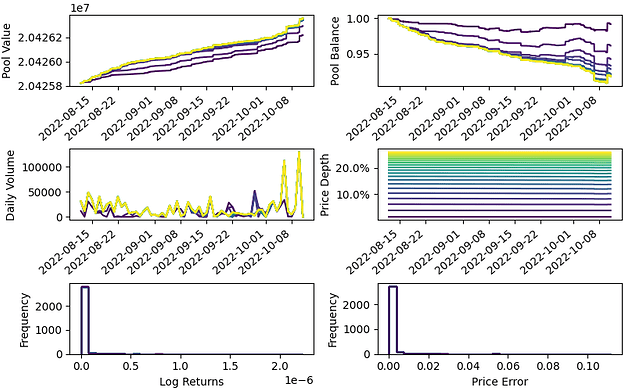

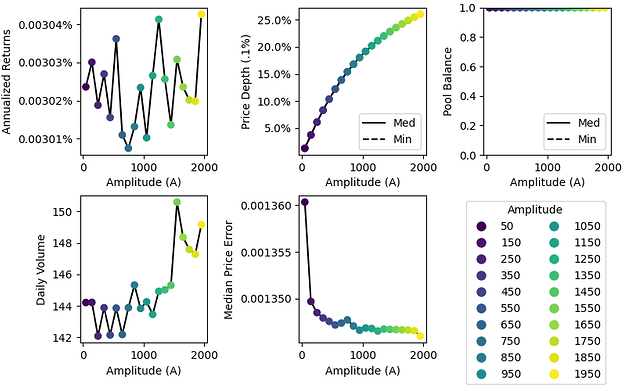

Consistent with GUSD’s historical price stability and low risk profile, our simulations suggest that A can safely be raised to above 200. However, the proposed value of 1500 may be unnecessarily risky, and is above GUSD-3CRVs current value of 1000.

Our simulations suggest that increases in returns saturate in the region of A=500, although there may be some leeway to go higher (i.e., to A=1000) given the limited risk of pool imbalance.

GUSD Simulation Results: 4 bps Basepool

GUSD Simulation Results: 1 bps Basepool

BUSD-FRAXBP

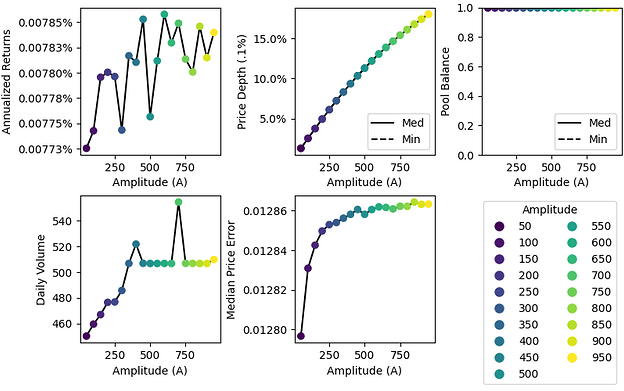

Both the BUSD and TUSD metapools produced noisy simulation results, presumably due to the limited historical volume for those coins/pools. In our arbitrage simulations, we limit trade volume in accordance with average historical volume over a 2 month span. When trade volume is low, different A values produce similar results because only limited portions of the bonding curve are utilized. Thus, results for these pools should be interpreted with caution.

Given the limited data, we tentatively suggest that the BUSD pool’s parameters should be approximately in line with the GUSD pool’s parameters, given their similarity in price dynamics and risk profile.

BUSD Simulation Results: 4 bps Basepool

BUSD Simulation Results: 1 bps Basepool

TUSD-FRAXBP

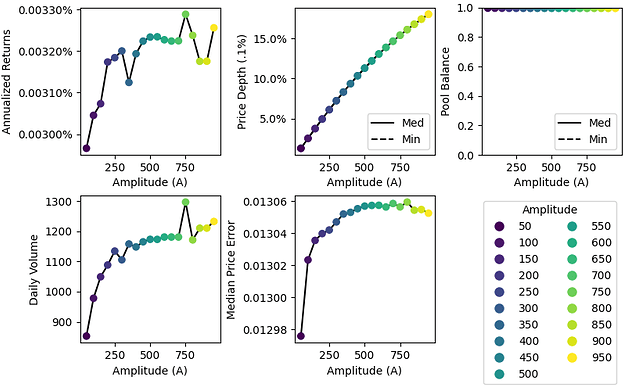

As with BUSD, simulation results for TUSD were largely too noisy to be conclusive. However, they do tentatively point to saturation of returns at approximately A=200.

TUSD Simulation Results: 4 bps Basepool

TUSD Simulation Results: 1 bps Basepool