Summary

This proposal aims to add the LUSD/crvUSD pool to the Gauge Controller.

Adding the LUSD - crvUSD pool on Ethereum to the gauge controller will help the pool to attract further liquidity as it enables users to assign a gauge weight and mint CRV.

References

- Website – https://liquity.org/

- Documentation – https://docs.liquity.org/

- Codebase: GitHub - liquity/dev: Liquity monorepo containing the contracts, SDK, and Dev UI frontend.

- App (list of 3rd party front ends): Liquity | Frontends List

- Twitter – Liquity

- Discord: Liquity

- YouTube: Liquity

- Dune Analytics – Liquity Dune

- Security Audits – Liquity Security Audits

Protocol Description

Liquity is an immutable decentralized borrowing protocol that allows you to draw 0% interest loans against Ether used as collateral. Loans are paid out in LUSD - a USD-pegged stablecoin and need to maintain a minimum collateral ratio of only 110%.

In addition to the collateral, the loans are secured by a Stability Pool containing LUSD and by fellow borrowers collectively acting as guarantors of last resort. Users borrowing against their ETH use decentralized 3rd party front ends.

LQTY is the secondary token issued by Liquity. It captures the fee revenue that is generated by the system.

Liquity as a protocol is non-custodial, immutable, and governance-free. No person or group has any control over the protocol — it is “set in stone” in smart contract code, and can never be changed.

Motivation

Liquity is deeply intertwined with Curve Finance, as the LUSD/3crv pool has been the main trading venue for most of LUSD’s existence. Currently, the LUSD/3crv pool is the biggest LP pool with LUSD with $23.7 mil. in TVL.

Besides, Liquity was the first protocol to ask for a whitelisting of its treasury for veCRV locking – a proposal that was accepted by governance and soon led to many other projects and DAOs following suit.

Curve is the optimal DEX for swapping price-correlated assets, thanks to its stableswap invariant curve. By rewarding the LUSD/crvUSD pool on Curve, we can boost the liquidity and attract more trading activity to the Curve ecosystem.

Specifications

-

Governance: Liquity has no governance. It is built to maximize trustlessness and decentralization.

-

Oracles: Chainlink is Liquity’s primary oracle. They are the largest player in the oracle space, have an excellent track record, sufficiently decentralized, and they’re constantly improving their systems.

Tellor is Liquity’s secondary (fallback) oracle. They’re fully decentralized — price data is requested, with a “tip” attached — and miners compete to push accurate data and win the tip. Inaccurate data is disputed, and the threat of stake-slashing incentivizes honest price reporting. More information.

-

Audits: Multiple security audits have been conducted by various auditors. All relevant documents are available here. Additionally, Liquity runs a bug bounty program with Hats Finance.

-

Centralization vectors: There are no centralization vectors. Liquity is built to have maximized resilience.

-

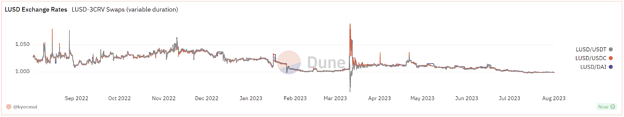

Market History: Last year we often observed a premium on LUSD coming from a structural unbalance between offer and demand further aggravated by events leading more and more users to worry about the censorability of centralized stablecoins (like USDC or USDT) and decentralized stablecoins primarily backed by centralized ones (like DAI or FRAX).

Over the course of 2023, three key factors contributed to a progressively tighter peg:

-

Users bridging onto L2 and selling LUSD to other stables.

-

Concentrated liquidity venues.

-

Chicken Bonds which allows Liquity to accrue protocol-owned liquidity which is then strategically deployed to liquidity venues.

You can check here the historical data of LUSD.

Other Specifications:

• Curve Pool: 0x9978c6B08d28d3B74437c917c5dD7C026df9d55C

• Curve Gauge: 0x66F65323bdE835B109A92045Aa7c655559dbf863