Summary:

This is a discussion in connection with the recent Llama Risk report and Tangible’s response. In the report, Llama Risk raised concerns that we believe warrants a pause on the USDR/am3CRV Polygon gauge until certain criteria are met. Tangible is an up-and-coming protocol that recently applied for and received a Curve gauge (proposal here) and they wish to continue gauge emissions.

This discussion is to make a case for or against taking any action on this gauge.

Intro:

Tangible issues the USDR stablecoin backed by a combination of real estate (RE), DAI, POL (USDR/am3CRV Curve LP), its own TNGBL token, and an insurance fund of various assets. Its treasury management strategy make it a unique hybrid RWA/algorithmic stablecoin, and this blend of collateral types was selected as a method to keep the system liquid amidst the challenge of custodying a rather illiquid asset class (RE).

As part of its growth strategy, the team manages the treasury by minting USDR from system gains (example tx), minting USDR from TNGBL (example tx), withdrawing DAI to purchase RE (tx1, tx2), managing POL in the USDR Curve pool (example tx), and managing the protocol insurance fund. These processes involve a high level of trust in the team, and some unusual activity in treasury management has prompted our concern about how user funds are being used.

Curve Pool Bribe Strategy:

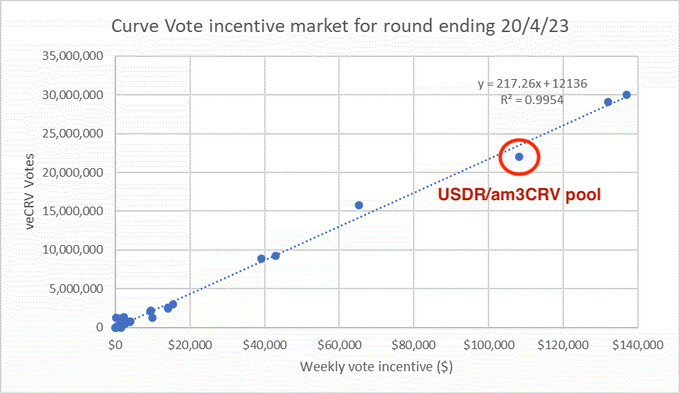

Tangible has been offering vote incentives on Warden Quest at 108K DAI/week for 2 weeks, and recently increased it to 162K DAI/week. This is a substantial sum, ranking it among the top 3 Curve pool bribers (currently second only to Convex’s bribe for the cvxCRV/CRV pool, notably made in its native token rather than stablecoin).

Previous round bribe compared to other bribes:

Source: https://twitter.com/HubertX13/status/1649465610940588033?s=20

In the latest bribe round, Tangible has sourced the DAI from 2 places:

- Binance - 223K DAI (tx)

- Tangible Bribe Manager - 114.8K DAI (tx)

The source of funding for the bribe manager is all traceable onchain. The bribe manager is controlled by the team and has a team allocation of TNGBL, it regularly mints USDR from TNGBL, and in this instance has swapped USDR to DAI, and bridged to Ethereum for deposit on Quest.

The Binance funds are a question that perhaps the Tangible team can clarify. We noticed large DAI withdrawals from the Treasury sent to Binance around the time that bribe funds began arriving from Binance. Each DAI withdrawal has an NFT minted with the tx that purports to represent a specific property purchased at the value of the DAI withdrawal. Tangible lists the properties with the unique NFT identifier on their website, but proof of purchase documentation appears to be lacking for all properties since the time Binance became a bribe fund source (since end of March). Tangible has rapidly expanded its real estate portfolio in the month of April (adding 32 of its 50 properties just this month), so it may be plausible that the immense workload to manage this expansion has left a backlog of paperwork to process. Tangible team perhaps can clarify on the status of documentation.

For Reference on Treasury withdrawals to Binance vs Binance deposits to bribe wallet:

- 500K DAI sent to Binance March 30 | 150K DAI sent to bribe wallet April 2

- 40K DAI sent to Binance April 12 | 73K DAI sent to bribe wallet April 12

- 500K DAI sent to Binance April 25 | 223K sent to bribe wallet April 26

To be very direct, I fear that user DAI deposits in the treasury may be, at least in part, being diverted from their stated purpose to purchase these particular properties. I am concerned that, instead, the DAI is used as bribes to fuel rapid expansion. Updated documentation for properties purchased in the month of April would alleviate this concern.

RE Purchase from DAI strategy:

I’ll elaborate more on this strategy that uses DAI deposits to purchase additional real estate properties because I did not realize this was a strategy outlined by the team. Perhaps they can point to a source that explains this use of treasury funds. (According to the docs, Tangible would mint USDR from gains in the treasury assets to purchase additional properties. DAI is used in the POL strategy, but I see no reference of using treasury DAI to buy RE).

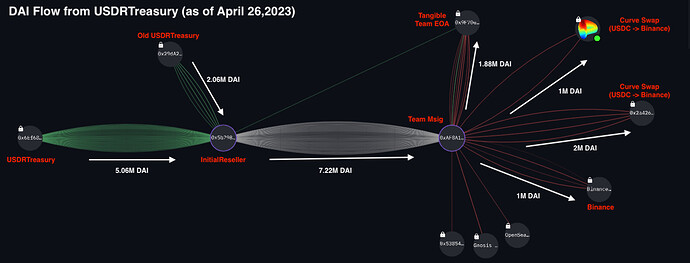

The image below shows the total DAI withdrawn from the treasury to allegedly purchase additional properties. The InitialReseller handles the exchange of an NFT to the treasury for the value of the underlying property in DAI. Those funds are passed to the Team msig, which make their way to Binance.

As an example of this process:

- Treasury manager initiates 138K DAI transfer from treasury for TNFT

- Treasury acquires TNFT with unique identifier 340282366920938463463374607431768211510

- Property of same ID number found on Tangible website

- 6 days later, 500K DAI, amounting to ~4 properties is sent to Binance

Since minting USDR from TNGBL is limited (and as explained below, is dominated by team minting), depositing DAI is essentially the only way end users can mint USDR. Furthermore, DAI is the only liquid asset that USDR can be redeemed against. Once all DAI is drained from the treasury, the team becomes responsible for liquidating RE in order to pay back the redemptions.

Mint USDR from TNGBL strategy:

Minting USDR from TNGBL is limited based on the proportion of assets in the treasury. The price of TNGBL takes the Uni TNGBL/DAI pool as a pricefeed with an upper bound set by the team treasury manager multisig. I haven’t seen anything that leads me to think the team is circumventing any of the limits they impose, but I have determined that the team accounts for >92% of TNGBL deposits in the treasury, mostly from their bribe manager and gov manager wallets (the former is used to fund liquidity incentives for the protocol, the latter is used to buy gov tokens such as CVX and VELO). While I can’t say for certain why the team accounts for such a high % of TNGBL in the treasury, I would speculate that it’s due to a high concentration of circulating supply in possession of the team and perhaps stronger incentives for average users to LP or lock their TNGBL rather than mint USDR.

This analysis shows flow of TNGBL to the USDRTreasury (note there have been 3 treasury implementations and the contents of the treasury are transferred from treasury1->treasury2->treasury3): Breadcrumbs - Blockchain Investigation Tool

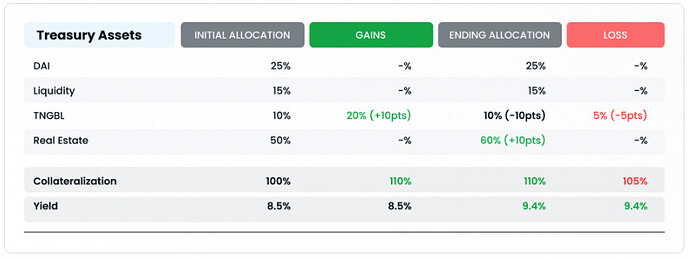

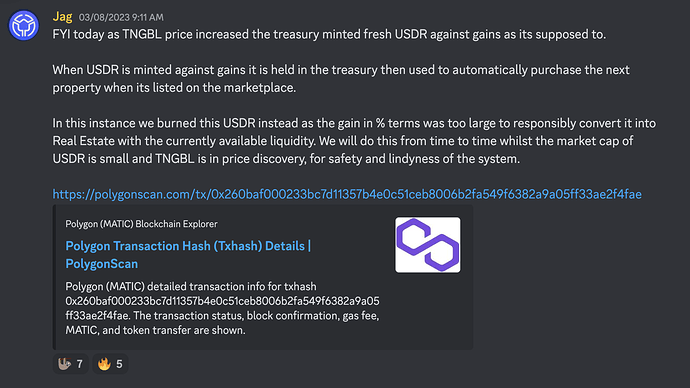

Between the bribe manager and gov manager, they have minted 1.7M USDR from TNGBL, ~8% of USDR supply. The treasury manager can choose to mint additional USDR from the treasury in case of TNGBL price appreciation. The team say in their response to the Llama Risk report “As the report notes, the price of TNGBL went up which resulted in an expansion to this component of the backing. While new USDR was minted against these gains, the team determined that the most responsible action was to burn this new USDR, preventing future undercollaterlization if TNGBL retraced. Minting against gains to TNGBL will be deprecated in USDR v3.”

TNGBL is essentially a one-way street in the tangible treasury. While it can be used to mint USDR, it cannot be redeemed except as a last resort after all DAI and RE has been liquidated and redeemed.

The Univ3 pool used as a price reference has very low liquidity, only having $264K TVL. Most TNGBL liquidity is in the Balancer pool, which is weighted 80%TNGBL/20%USDC.

TNGBL’s inclusion in the treasury amounts to a “growth hack”. It would not take much to push the price of TNGBL up and increase USDR minting potential. The team claim themselves that the reflexive nature of this collateral type is high risk and they don’t plan on using this functionality to mint from TNGBL system gains in the future. I think that’s a great decision for the future stability of their system. I’d go further and say the inclusion of TNGBL as a collateral type AT ALL presents an undue risk to maintaining system solvency, given the illiquidity of its primary collateral type (RE).

Conclusion:

The Llama Risk report says we believe the gauge for this pool should be paused until the following criteria are met:

- Integrate the Proof of Reserve and RE valuation reports from a trusted third party auditor and oracle service

- Remove TNGBL as a collateral type

The team have said they are working with Chainlink and an independent auditor for the first point. This would alleviate concerns raised in the Curve Pool Bribe Strategy and RE Purchase from DAI strategy sections.

The team have said they plan to eliminate TNGBL mint from system gains in the future. There’s no need to include this collateral type. RE + DAI and the POL strategy are sufficient to build Tangible into a successful protocol. Endogenous collateral types are highly risky and likely not regulatory compliant. The system would be much more sustainable by eliminating this collateral type.

I stand by the recommendation in the Llama Risk report that we need to pause the USDR/am3CRV gauge until these two points have been satisfied. I would further urge Tangible to refrain from bribing the Curve pool until they have provided reasonable assurance about the use of treasury funds.

Final Note:

As a final note, I want to say that Llama Risk has been in contact with the Tangible team while researching for our report, and they have been forthright in all our dealings with them. They appear to be a team that believe strongly in the viability of their product and have clearly put a great deal of work into building Tangible into what it is today. I don’t have any reason to believe, based on my dealing with them, that there is any intent of wrong doing. It’s my hope this post is received as an objective analysis; I’m not looking to FUD this team or their project, I’m trying to lay out the facts and the relevant questions that ought to be answered. Ultimately, I stand with team Curve and all the stablecoin protocols building with it- I want to see Tangible grow to be a successful protocol for the long term.