Summary

Proposal for the open collaboration of OnePiece as a multi-chain operational system available for Curve users.

Proposer

Chris D. Beckman, Head of Business Development at OnePiece, is submitting this proposal on behalf of NatureLabs, the creator of OnePiece.

Abstract

Onchain composability plays a pivotal role in Defi’s evolvement for both end users and developers – a high percentage of their onchain tasks, strategies or new protocol construction requires interoperations across multiple protocols combined with calculations & data monitoring.

OnePiece is the first multi-chain middleware layer that renders swift & automated access to onchain application & onchain composability, aiming to substantially reduce the barrier & cost of utilizing onchain composability of Dapps to accelerate the development & adoption of Defi. In specific, OnePiece provides :

-

End users with a set of automated Defi Task Types, which :

A. Turn complex manual execution of a typical Defi task to a simple 3-step task definition process.

B. Optimize user’s capital efficiency.

-

Developers with :

A. As Infura is saving developers effort for node setup & maintenance, Onepiece wants to save comparable amount of effort when developers access Dapps;

B. Onchain data requires considerable effort in processing & structuring before they are ready for use, even for data provided by “The Graph”. Onepiece saves that for developers.

Benefits

For Curve’s users,

- Increased revenue for liquidity providers. OnePiece users can swap assets directly from Curve’s pools, generating more fees payable to Curve’s LP.

For Curve’s users (using loan),

-

Provide a 2-level protection against liquidation:

a. Keep user’s collateral ratio to preset target through auto rebalancing across his lending position & farming/staking positions.

b. In case of rapid collateral ratio rise, part of the collateral is sold via Flashloan to return to the target collateral ratio to avoid liquidation.

-

Increase users’ capital efficiency (up to 50%): When the collateral ratio drops below preset standard, it will return to the target collateral ratio by auto borrowing extra to increase user’s predefined farming/staking positions

-

Save much of user’s manual execution for tasks involving interoperations between Curve & other protocols through automation & auto data monitoring.

For developers,

-

Provide more uniformed ABI to access Curve smart contracts to shorten the learning cycle.

-

Provide processed & structured Curve data to save data acquisition & processing time.

-

Provide documents to accelerate user’s development on top of Curve.

For Curve,

-

All the above should increase Curve’s adoption rate and transaction volume through enhancement in user stickness & reduction in user’s concern with risk & overhead of using Curve.

-

Increase liquidity in Curve’s pools & swap due to the exposure to new users.

-

As the backbone in Defi, Curve is accessed by many developers in various cases to compose new strategies, tasks or protocols. Increased accessibility to Curve smart contracts & data could further enlarge Curve’s impact in the ecosystem.

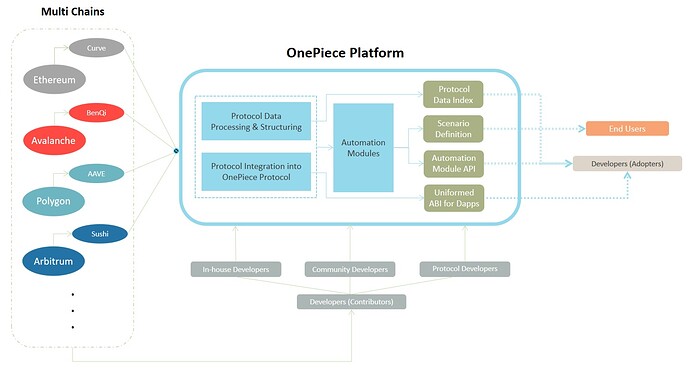

Architecture

3 building blocks lay the foundation for Onepiece’s improved onchain accessibility:

- Protocol Integration: Integrating major Dapps on mainstream blockchains;

- Data acquisition, processing & structuring for all integrated protocols;

- Automation.

Background

Founder:

With MS in EE from Delft University of Technology, Luffy started as engineer/researcher at Intel Eindhoven, NL. & computer system lab of Stanford University, successively. Then he became a strategy consultant in Accenture and Mckinsey, Amsterdam Office. In 2018, Luffy founded a leading aggregative OTC platform adopted by 100+ crypto-exchanges, wallets and mining platforms. The company shifted focus to Defi asset management since March 2020 with sizable AUM.

Implementation

Milestones

OnePiece sets milestones in the following dimensions:

-

TVL managed through OnePiece:

a. 1 Billion TVL managed through OnePiece in 4 months after launch

b. 5 Billion TVL managed through OnePiece in 1 year after launch

-

No. of Task Types provided:

a. 6 in 4 months after launch

b. 12 in a year after launch that covers 70% of the frequent operation cases

c. From month 12 after launch, 30% of the additional ones are contributed by the community and other protocols

-

No. of Integrated chains incl. L2:

a. 3 in 4 months after launch

b. 8 in a year after launch

-

No. of Integrated Protocols:

a. 25 in 4 months after launch

b. 80 in a year after launch

c. From month 12 after launch, 60% of the additional ones are contributed by the community and other protocols

-

No. of processed protocol data instances:

a. 25 in 4 months after launch

b. 50 in a year after launch

c. From month 12 after launch, 75% of the additional ones are contributed by the community and other protocols

Useful Links

2 Likes

Thanks for the proposal. What is the advantage of using onepiece as opposed to us just building an in-house bot that submits transactions to alternate chains? Are there tradeoffs in security for devs/end users ? And at what level does integration take place, for example would integration require modification of existing smart contracts or are there wrappers that would need to be deployed?

2 Likes

@skellet0r Thank you for your feedback. Here are the answers to your questions :

-

The multi-chain aspect of OnePiece is negligible for Curve users, you are right, but this is not exactly what we intend to provide. The real benefits mostly come from the automation offered by OnePiece. Users will be able to set reactive thresholds to their positions in order to maximize their capital efficiency. (e.g.: If you are borrowing assets to farm on Curve, your collateral would be protected by the system automatically transferring your funds across each protocol involved, therefore keeping your collateral ratio to the preset level. This would not only protect you against liquidation but also increase your position in curve in case of a drop in collateral ratio.)

-

There are no tradeoffs in terms of security. The fund invested would remain in Curve custody. OnePiece does not hold custody of user’s fund. The risks related to smart contracts always exist, but if you trust the protocol ( Curve in this case) the risk remains the same.

-

No effort is required for Curve. The integration has already been completed. Our main objective with this proposal is to let Curve’s users know about the existence of OnePiece and its benefits.

If I my answers were not perfectly clear, please let me know, I would gladly provide more information.

1 Like

It seems that onepiece is a tool protocol. But what he can do for curve is not only to make it easier to use multi-defi protocols.

Is there anything else?

2 Likes

Hi @guoxinchen.eth,

The multi-DeFi aspect is only the basis of OnePiece. The real functionality comes with automation tooling:

-

Intelligent Loaning Keep user’s collateral ratio to preset target through auto rebalancing across his lending position & farming/staking positions

-

Flash Repay Secure lending positions in times of severe market volatility.

-

Position Building Build complex investment positions (e.g. Leverage Yield Farming) across multiple protocols in a few clicks.

-

Auto Compound Automatically claim rewards, make the appropriate swap in order to increase the user’s farming/staking positions.

The second layer of benefit will come with the indexing tooling for developers, making Curve’s integration significantly easier for new developers/protocols, therefore increasing Curve’s exposure one step further.

We will soon release demos/videos that will explain in detail each of those tasks. All announcements are going to take place via our Discord/Twitter account. Any feedback is welcomed.

1 Like

Ah okay makes sense, so this isn’t necessarily a proposal requesting integration from Curve. Just a way to inform Curve users that Onepiece exists

Also for users interested in this, could you clarify on the smart contract wallet method that onepiece requires users to use. Obviously this isn’t just users with EOAs (otherwise what’s the point of Onepiece), instead onepiece has it’s own custom smart contract wallet implementation which users put funds into. Does the smart contract implementation use proxies ? Are there any admin controls that have access to user funds? (if either of these are true, then onepiece is in fact a custodian of user funds).

Also I can’t seem to find a github link, or any reference to smart contracts deployed (and their addresses w/ verified source code) which is definitely required

2 Likes

Seems a good tool for the Curve liquidity providers. By the way is there any fees while using OnePiece?

2 Likes

Thanks a lot for your reply and questions, which bring us the opportunity to provide some clarification about the protocol:

-

About the security :

Every user creates a dedicated smart account on Onepiece, which is a smart contract accessible to user’s EOA and Onepiece smart contracts for automation. Only the user has the right to withdraw funds from this smart account as he/she is the owner & creator. In order to trigger an automation task based on onchain data monitoring & calculation, Onepiece Admin must play the role to initiate this process since we don’t have users’ secret keys. However, the admin only has the right to trigger the automation task which moves user’s funds across protocols approved by the user, but not to withdraw, which is hardcoded in the smart contract for smart account.

One thing to clarify about security/decentralization: every transaction within any user-defined automation task executes only with users’ signature, meaning no transaction could take place without user’s signature. But apparently many users value the manual effort saved by the automation & don’t want to sign every transaction manually. To prevent users from signing every transaction while keeping the security level of the transaction ;

- We restrict the types of automation tasks & the relevant pools that the signature could apply in the smart contract upon user’s selection

- In order to automate execution, we utilize EIP-2612 to keep user’s signature alive for the selected automation task for a certain amount of time, say a couple of days. User will be notified to provide his signature once again before the signature expires.

Additionally, we have 2 modes of automation available to users 1. Full automation: users authorize once, the signature will be valid for a preset term, within which every transaction will be executed automatically with notification to users through email/telegram 2. Semi-automation: user will be notified of the triggering of a transaction through email/telegram, but he/she has to sign it before it could be executed.

This way 1. No risk of secret key exposure exists 2. Even if any security glitches were found, the worst case is user’s funds moving across his/her selected pools controlled by himself. No funds could be taken away.

So the smart account is completely decentralized, we don’t act as custodian.

2.Github Link:

We are in the process of external auditing, Github will be open source right after that, which is pretty soon. For now, the Github is restricted to whitelisted accounts. We could put you in the whitelist if you want.

Please feel free to let us if you have any additional question. We are happy to answer them with the belief that the open automation platform we are building could contribute a lot to the growth of Curve’s ecosystem. For instance, one of the automation function that we are about to provide is auto-rebalancing user’s positions across multiple curve’ stablecoin pools based on APY, VE, size, cost etc. to maximize user’s capital utilization on Curve. Your opinion is quite welcome & appreciated!

2 Likes

Hey @smartcrypto,

Thanks for the feedback. To answer your question, OnePiece is charging no fees at all for end-users. Since we designed this platform with the primary objective of increasing users’ capital efficiency, we agreed on keeping it charge-free. Certain charges may apply for developers using our indexing services, but as for liquidity providers, the only fees that you would have to pay are normal gas fees that would otherwise occur while depositing your assets in a pool.

2 Likes

Hey mate,

We just release multiple Videos/Demos on our YouTube. In case you wanna have a look

1 Like