Summary:

On June 12, 2024, several sUSDe Llamalend users were hard-liquidated due to a crvUSD upward depegging event. The total loss is about $31,000. The incident has been reported by the LlamaRisk team, and actions will be taken to prevent similar occurrences: crvUSD Upward Depeg (June 12, 2024) Incident Report - Llama Risk.

This proposal aims to repay affected users for their losses using Curve Grants funds. Total amount approximately: 30,928/0.2846 = 108,671 CRV

Motivation:

The incident was caused by an upgraded version of the PegKeeper (V2), which was introduced to prevent spam attacks. As a side effect, the surge in crvUSD demand during the mass liquidation of Mich’s position caused crvUSD to depeg upwards to as high as ~$1.15, which PegKeeper couldn’t prevent due to the newly introduced ‘deviation’ check.

Llamalend markets by design should only liquidate based on dropping collateral value, but never due to an upward depegging of crvUSD.

Specification:

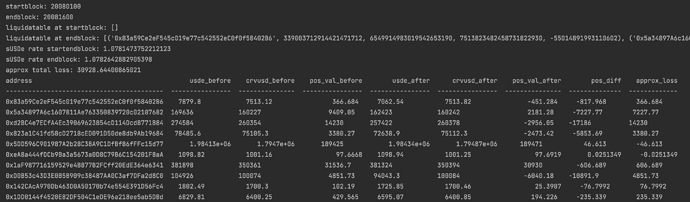

The following approximate losses were suffered by the sUSDe lend.curve market:

Curve.fi AMM: 0x6505aeC799AC3b16a79cb1Ae2A61884889b54C1b Controller: 0xB536FEa3a01c95Dd09932440eC802A75410139D6 Monetary Policy: 0xf574cBeBBd549273aF82b42cD0230DE9eA6efEF7

For:

PegKeepers didn’t respond as expected due to a newly introduced design flaw. This caused crvUSD to depeg upwards and liquidate several positions.

lend.curve markets are marketed as isolated markets. They turned out not to be isolated as the sUSDe pool liquidations were a direct cause of the liquidation demand in the crvUSD/CRV pool.

The learnings from the incident are valuable for the protocol, warranting compensation to build a more resilient model for the future (Recommended Mitigations section: crvUSD Upward Depeg (June 12, 2024) Incident Report - Llama Risk).

Against:

Llamalend is advertised as BETA. Usage is 100% at your own risk.