Summary:

Create LSD pools on Llamalend e.g. stETH/ETH

Abstract:

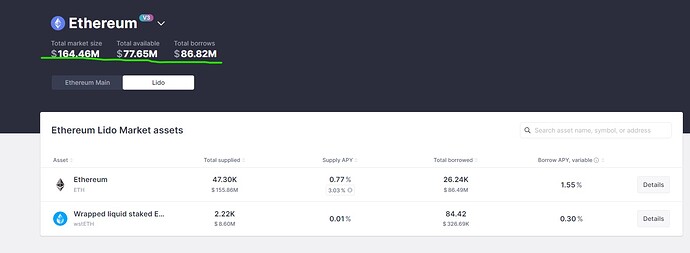

Llamlend and crvUSD is a huge revenue source for Curve. DeFi users mainly borrow $. However some DeFi users are using leverage strategies using LSD around difference of yield between Liquid Stake Derivate and borrowing native chain token (e.g. ETH…).

Sometime, there is a depeg between on LSD stETH vs ETH on secondary market, there could be on opportunity for Llama lend to solve the depeg problem with the soft liquidation algorithm.

There is a market already available on DeFi Saver.

DeFi Saver

Motivation:

This proposal would increase revenues and TVL to the DAO.

Specification:

to be discussed , stETH , rETH,

For:

New revenues streams, new pools, listing of small market size LSD token.

Possible application on new markets with small LSD borowing / lending : stBNB/BNB , stAVAX/AVAX, stMATIC/MATIC, stFTM/FTM …

Against:

Time required for implementation, market too small for Curve