It’d be nice for gov users to ground their opinions into reality instead of conjecture or rumours they heard on twitter

This is getting away from the actual point but 3 digit APYs are not sustainable and I think Andre realises that as much as anybody else.

Unless we’re talking about scammy tokens, I don’t see any reason to exclude this or any pool from Curve. It’ll bring attention and use from Asia and a fourth Btc on Ethereum option. If peple don’t want to use out, it will die out and there is no harm done.

For players who use CNY, they prefer to use QC

Looks like the poll is quite contentious. I would put it up to voting in governance, and wouldn’t vote myself also.

Everyone who has a power in governance is encourage to participate when it’s up

No one asked for this and it’s concerning why it’s even being proposed here.

It would be good to get an honest assessment from OP as to why it’s being suggested other than:

This would bring more liquidity to the Curve protocol as well as a new Bitcoin on Ethereum option

Integrating centralised wrappers into Ethereum is not desirable for the ecosystem.

People should realized that aside from CRV distribution, the pool is separated from each other isn’t it.

HBTC is ideal Wrapped BTC. BTC <–> HBTC no slippage is done automatically when you withdraw BTC from Huobi Global Platform using ERC20 network. HBTC can enjoy the speed of ETH network and the liquidity of BTC. User can save a lot of time and fee from minting Wrapped BTC. HBTC is BTC but WBTC not BTC because you can convert your HBTC to BTC in no time. HBTC should be promoted to more crypto trader.

Maybe you should do that instead.

Working on Monero since 2014 and Huobi is the most scammy and shady exchange i ever had to deal with. Personal experience.

Everyone long enough in this space knows how shady certain chinese exchanges are.

It is no surprise most plustoken ponzi btc were sent to huobi: https://www.theblockcrypto.com/genesis/51084/huobis-role-in-enabling-plustoken

Weight-voting CRV is a variant of incentive (up to them)

The risk is really contained to only that pool b/c it’d be an separate smart contract

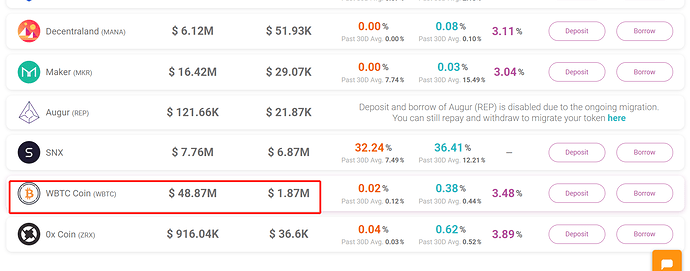

wBTC is a centralized wrapper to Bitcoin. USDC, TUSD, USDT, BUSD and PAX are centralized wrappers to USD…

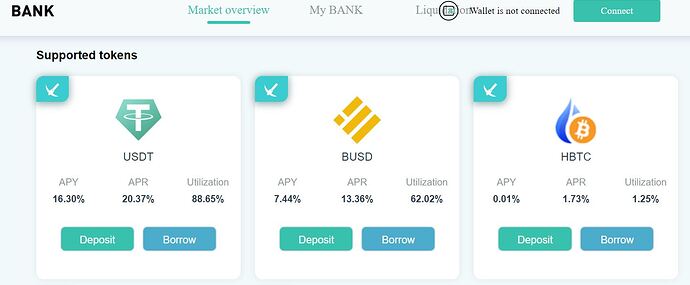

ForTube is a lending protocol, many hbtc holders deposit to ForTube and get interest, also can borrow stablecoin at ForTube.

There are degrees of centralization for each of those tokens. Some tokens are also publicly auditable or have been audited by regulated entities (wBTC, USDC) and others have not (USDT, hBTC).

USDT’s opaque accounting is somewhat overruled by its enormous liquidity. hBTC, on the other hand, has no redeeming qualities at all.

EXACTLY this

The risk of blacklisting of the other components of the pool is significant

Curve is literally endorsing a super shady exchange that welcomes hackers and ponzi’s if they add this. Curve puts its stamp of approval for rough 1:1 peg when they add a pool - Why would Huobi (hacked, ponzi) BTC remain at a 1:1 peg? It shouldn’t and won’t

This isn’t any type of anti Chinese thing also. It’s about Huobi as an exchange having ZERO problem taking on and laundering hacked and ponzi BTC en masse which crashed the BTC price to $3k btw.

Rumor on twitter? You mean proven by Chainalysis and ErgoBTC samourai reports and others?

https://blog.chainalysis.com/reports/plustoken-scam-bitcoin-price

No sorry it isn’t hUSD can be printed out of thin air and a collapse of it will damage everyone involved in curve from crv token holders to liquidity providers. Unlike wBTC there’s no multisig and custody providers involved.

There’s no point in adding it as bUSD is also a dead pool, unlike USDT it’s not the major stablecoin and unless USDC it’s not by “trustable” entities that are in a major jurisdication like the US either.

I can see why we need USDT, i am fine with that, i use it too, but there’s zero reasons to use bUSD, hUSD and co.

@Louis_xman - Fair point. But also consider that HBTC’s utilization on ForTube is 1.25%. That’s quite low.

so basically 50x lower than BUSD which is already a dead pool here.

- That doesn’t mean anything, right. You can see wBTC utilization on AAVE is 3.8%. HBTC and wBTC holders can pledge it on ForTube or AAVE, then borrow stablecoin to use for themself. This is the possible application scenario.

Just to clarify - adding a gauge will be with 0 weight in the DAO. So all the gauge weight and it’s portion of CRV is decided with Gauge weight voting on dao.curve.fi/gaugeweight - if noone votes for that gauge, it won’t get any CRV inflation