More options to kickstart liquidity and usage of Bitcoin on Ethereum always welcome

Why not just make a direct PlusToken and other Chinese ponzi’s (Source: Chainalysis, ErgoBTC Samourai reports, TheBlock, Forbes etc al) to WBTC bridge? No thanks

Agree. hBTC is a bad move.

Huh wow. Hearing about this stuff for the first time!

To me, sounds like a good gateway to Huobi

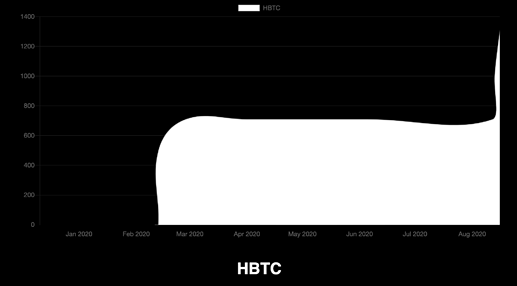

Also if you check https://btconethereum.com/, HBTC has been completely static at 700 btc with no actual use or traction for over 6 months. If people want to acquire wBTC on curve they can do so via curve’s very own UI with real BTC seamlessly. I hardly see how this is needed or desireable at all.

I’m on the side of excluding hBTC, but it’s worth noting that market size looks to have nearly doubled recently.

I would really like to see preparations for tBTC to be added to Curve’s pools over others.

Second this all for tbtc. Hbtc… Never used it seems like a waste of a pool.

hBTC is stupid, it’s just stacked up counterparty risk adding huobi as another giant point of failure.

Can we get Huobi to do some incentive on this?

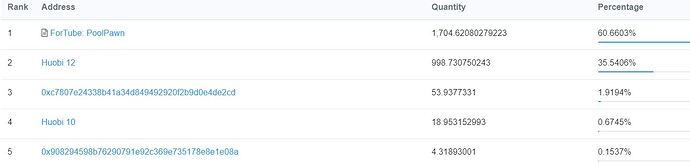

That’s not right as HBTC’s circulating supply on 26/Aug/2020 is over 2,810, besides, from the holder info on etherscan it shows Fortube this protocol holds 59.59% of it (2,810 HBTC); and further more that WBTC is the ERC20 token backed by BTC and its minting process is a bit complicated with higher minting fee charged however, minting of HBTC is much easier (Huobi users can directly and easily mint HBTC on Huobi global, Huobi Korean), and minting fee of HBTC nowadays is around 0.00005 BTC (~0.5 USD).

Interesting watching closely…

I think it is an interesting move worth exploring.

I looked on CoinGecko, Nomics, and CoinMarketCap. I couldn’t find a quote for hBTC. I did find it on Etherscan, but I’m left wondering… is there’s really a market for it?

Perhaps it’s relevant that the top 5 holders seem to control 99%.

I see no practical use of centralized hBTC atm. This pool is only going to dilute current CRV distribution for LPs. Voting “NO”.

More inclined to adding ETH related pools.

Yes! As my old economics teacher used to say: More is better.

Your economic teacher seemed not to listen to that old wise song “And too much love will kill you” by Freddie Mercury.

This unnecessary pool will dilute CRV incentives of the current pools and make the overall APY less attractive to LPs taking into account falling CRV price. For BTC pools it’s already below 40%. Competitors are not sleeping.

Not only that but also SHADY HUOBI will use customer funds for this…I don’t want my btc etc associated with that scam where Plustoken ponzi laundered all their btc, i am not feeling like getting my USDC etc blacklisted because Huobi is laundering money via CURVE.

Yes, I just tweeted if there is any personal interest involved

Below 40% APY for a risk/reward ratio that is completely skewered because of information asymmetry and maxi-principles? I think you have to get used to it, it will probably be heading towards 20-30% for all pools. More pools, more volume, more fees, more value for the crv tokens. More love, but not a lethal amount.

After Andre Cronje set new standards for the industry the rules of the game have changed. Now 40% APY is far from attractive in yield farming.

It’d be nice for gov users to ground their opinions into reality instead of conjecture or rumours they heard on twitter