How do you actually get the physical gold ? Is this also only for the US and Australia?

Answer: UPXAU are backed 1:1 by GoldPass Certificates. The Perth Mint is the custodian of the underlying physical gold that backs all GoldPass certificates, with every ounce of gold guaranteed by the Government of Western Australia.

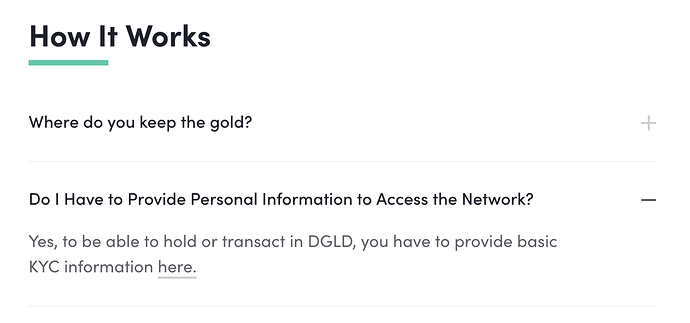

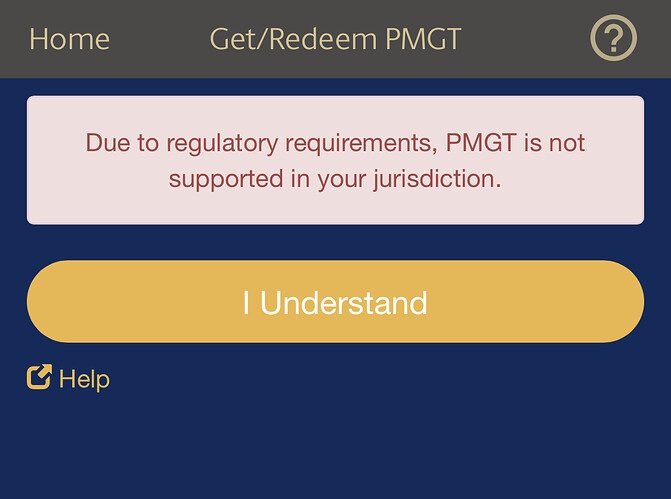

The question was not “What is UPXAU backed by?” it was “How do token holders convert their tokens into physical gold?” (as in how a token holder get a physical bar that they can hold in their hand). What countries can do that? Is it US and Australia only? If not what countries are supported? PMGT claimed it was redeemable in the US and Australia only but apparently some US persons got a message that says “Due to regulatory requirements, PMGT is not supported in your jurisdiction.” (see above). Also, what does it cost to redeem?

Answer: The guarantee by the Government of Western Australia of The Perth Mint’s gold is not limitless. The Perth Mint’s inventory is closely monitored by its auditors and not allowed to decline below its guaranteed reserves.

Agreed, except for “not allowed to decline below its guaranteed reserves.” Unless Perth Mint simply stops to selling, when the reserves reach the minimum, supply and demand will decide what their reserves will be. If they simply stopped selling, are you suggesting they will hold a separate special reserve for Gold Pass redemption only? Would it be enough to cover all outstanding Gold Pass certificates? Would GoldPass redemptions be allowed or would they be halted until the minimum reserve is exceeded again? Is there any documentation on this anywhere?

How does that answer the original question. What is the recourse against UP Alliance then?

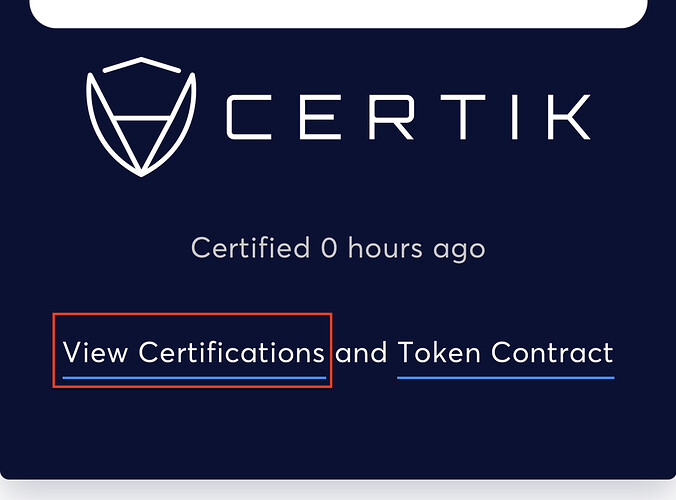

Answer: > If the Alliance were to disappear, you would still have a 1:1 substantiation between GoldPass Certificate and Token. UPXAU can only be minted if there are the same amount of GoldPass certificates backing it. CertiK is the code auditor.

Sounds to me like it’s just “trust us, they are all there.” I am asking what is the token holder’s recourse (and against whom) in case it turns out the backing is not 1:1 for any reason or “the Alliance” or one or more parties become insolvent (not the mint, any/all others involved)? How can the Gold Pass backing be transparently verified and guaranteed by the blockchain/smart contracts? How can anyone independently verify and determine this? I don’t see any way to do it.

It’s worth noting that auditing the code is different than a financial audit of the supply of the certificates, who holds them and that they are not otherwise encumbered. Seems like the Perth Mint themselves would be the best party to be attesting to how many Gold Pass certificates are held by any given token issuer and also that they are not otherwise encumbered in any way. Why wouldn’t this be public? Shouldn’t the Perth Mint, for example, be able to put on their webpage somewhere a statement that InfiniGold, Up Alliance or whoever holds X certificates and keep it updated in real time?

How can the general public see and verify “the Alliance” and/or Infinigold’s Goldpass Account balance?

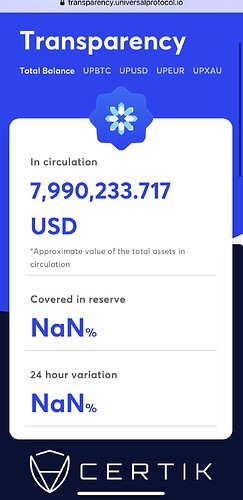

Answer: > Go to the transparency page – www.universalprotocol.io

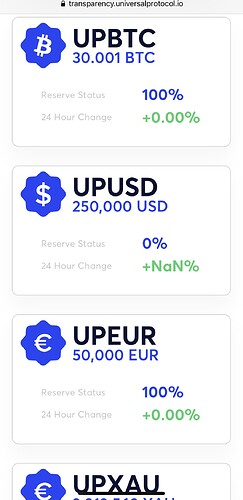

This page doesn’t even include the words “transparent”, “transparency” or even “gold”.

Answer: > **Go to the transparency page – and see for yourself. CertiK is a well respected institution.

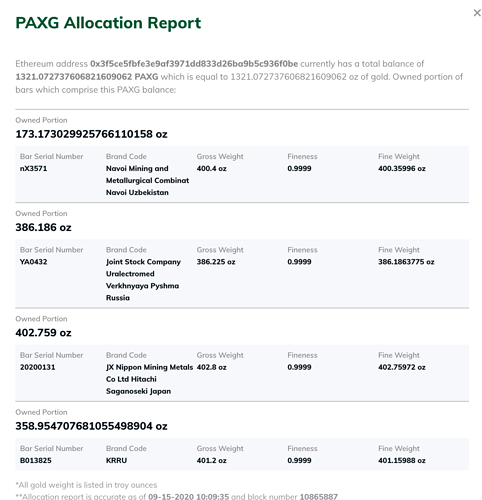

“Trust CertiK” is not an answer, especially not in the blockchain world. This is just a web page with numbers. Where is the actual proof about the number of certificates held? The number of tokens minted is never going to be in dispute, any block explorer will show that at any time. The question is how can the number of Gold Pass certificates currently held be verified by the general public? Do these certificate have serial numbers or some kind of public digital/cryptographic proofs on who holds them? How does anyone know how many certificates are held besides “trust us” or “trust CertiK”? Other tokens provide bar serial numbers, brand, purity, weight, etc. What does UPXAU and PMGT provide?

edit 2: forgot additional screen shots of the “transparency page”.

What does %NaN mean?

edit:

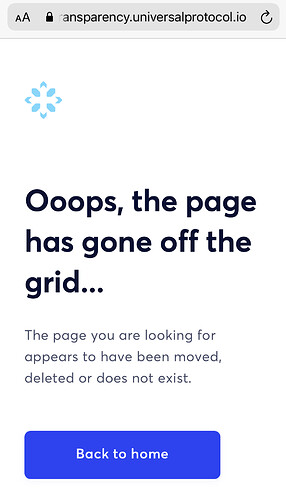

Also found the “view certifications” link doesn’t link to anything (this one doesn’t work either).