@charlie_eth

Supply is currently approximately 1,102z. Currently we can ship to US and Singapore. Many more countries will be added soon, COVID has unfortunately disrupted shipping. Almost anyone can redeem for USD, there are just a few countries that are restricted due to sanctions lists. Anyone can take delivery in person in Singapore as long as they are not on a sanctions list.

@syeh

Redemption: PAXG can be redeemed directly for USD at spot price, for unallocated gold or gold bars (430oz). We do also offer smaller physical gold redemptions via partners for denominations as small as 1 gram. Believe partners now deliver to UK, US and Canada.

Agreed, however the fees to redeem to USD start at 1% and only scale down to 0.15% at redemptions >= $400K. You are also limited to a single, centralized bidder and you cannot take delivery of your gold and go elsewhere if you don’t like the bid unless you hold >=430 troy ounces and in that case you will almost certainly be left with extra tokens to dispose of.

The smaller redemptions through Alpha Bullion have huge fees - 25% for gold eagles, 8.2% for 1 oz bars and 4.4% for a 1 kg bars. You can redeem a 100g or 1 kg bar with CGT for 0.15% or less than 0.50% shipped to a US or Singapore address (many more countries will be added after COVID restrictions are lifted).

Regarding lack of details using the “Allocation Report” tool - it’s stated that the tool does not work for custodial exchanges/wallets (tool limitation rather than lack of gold backing). Paxos does publish monthly attestation reports audited by Withum which certifies the requisite backing.

Where is that stated? What possible reason could there be to not provide full list of bars? Without such a list, how could anyone determine if all the tokens are actually fully backed? Why is the circulating supply reported as 100.00%?

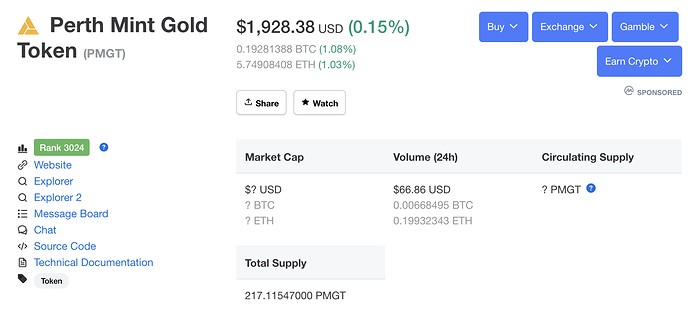

The linked attestation report is already more than one month outdated. It also doesn’t provide a full list bars with weights and purity and it only attests to 25,889.153 troy ounces while the current supply is apparently 30,691 troy ounces. An audit or “attestation report” only attests to the existence of bars as of a specific point in time while the CACHE Explorer provides near real-time data on all of the bars backing CACHE. We respectfully disagree that this “Attestation Report” provides appropriate transparency for an asset-backed token. Furthermore, we also believe that Coin Market Cap doesn’t compare “apples to apples” by reporting 100.00% of total PAXG tokens as “circulating supply” but significantly less for XAUT, CGT and PMGT (DGX is reported as slightly less) and wonder if this is due to the fact that Coin Market Cap is owned by Binance and PAXG was recently listed on Binance.

Furthermore, it sounds like the attestation report gives no guarantees as to whether or not the gold is otherwise encumbered (in addition to the tokens) “In addition, we have not performed any procedures or provided any level of assurance on the financial or non-financial activity of the Gold Reserve on dates or times other than the Report Date and Time noted within this report.” but perhaps we’ve misread that. What is clear is that that attestation report is only valid as of the date and time of the report.

@Jon

Current circulating supply of CACHE Gold is always reported on our home page, token supply page and in the CACHE Explorer. We also have a supply API available upon request. Anyone can audit the supply of CACHE Gold and its backing at any time with publicly available data.

Also, I don’t know much about gold or tokenized gold. And so it might very well be that market cap doesn’t matter. Maybe trading volume doesn’t matter either. Just curious, what does matter? What should we be looking for?

We’d argue that redeemability and transparency are the most important factors. There is no question that currently gold tokens in general lack liquidity and demand, however we believe that Curve (and other DeFi platforms) can help change this. Gold is a key asset for digital asset investors looking for a less volatile safe haven asset that is not inflationary. CACHE Gold can expand its supply to meet demand very easily because of its partnerships with vaults and liquidity providers which currently add billions of dollars in liquidity annually to precious metals markets.

More importantly, why is it worthwhile to host this tiny market? Let’s say Curve doubles the market, and that 100k/day of trading volume goes to 200k. And at 0.04% fees, that means that even then total trading fees would be $80 dollars a day, or $29k/year.

Does that get anyone excited? Can someone please explain how we make money here?

The gold market is much bigger than all the assets listed on Coin Market Cap combined. Above ground gold has a current value of approximately $12.3 trillion vs. $325 billion (according to Coin Market Cap). The potential for asset backed tokens, including but not limited to gold, is huge. Gold is a good place to start.