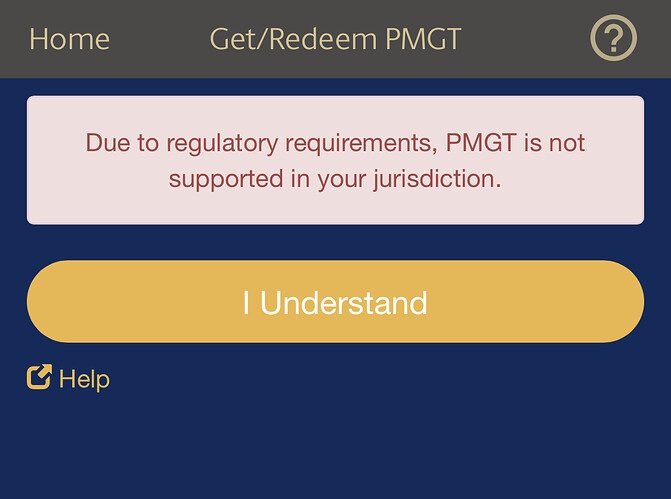

This looks like the worst of all of them (even worse than XAUT).

MKS (Switzerland) SA, part of the world’s most trusted gold group in Switzerland.

Who is the central authority that decides who is the “world’s most trusted gold group” (whatever that even means)? I must not be on the mailing list for their newsletter.

side-chain built on the Bitcoin network.

So some proprietary bs that’s centrally controlled like Tether Omni but significantly worse because you have to “apply” for a wallet.

The team recently launched wrapped-DGLD which is an ERC-20 token on the Ethereum network that is pegged one-to-one with…

So more steps and more gas to burn.

1,500 tokens controlled by 5 addresses with an implied value of ~$280,000 assuming the current exchange rate for wDGLD/USDT on Uniswap is correct (or close to it). I cannot check this because I do not possess the advanced mathematics degree required for pricing DGLD.

have direct access to create/redeem at will while maintaining no spreads on the price of gold (unlike the other gold tokens which results in wDGLD being a good stable gold token to arb with to fetch yield).

Sounds like nonsense. Any issuer of any token can do this if they want to. Unless a gold producer is donating gold to them, there’s always a spread but for major dealers and distributors it’s small.

Some additional links here.

Indeed:

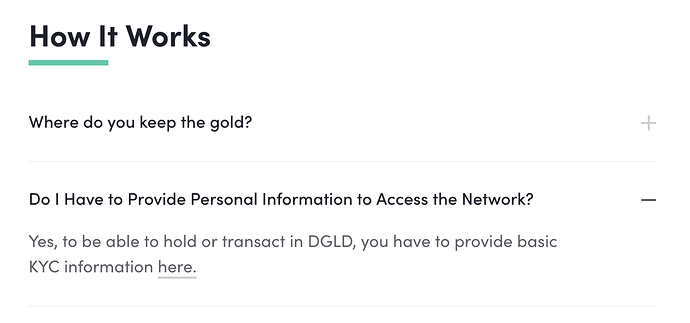

- "All Network Participants Are KYC’d

The KYC requirement for DGLD wallets means no known bad actors can transact in the DGLD network."

Hardly seems like a selling point for a token being proposed for DeFi platforms.

-

They claim it’s redeemable but there doesn’t seem to be instructions on how you can do it on the website. It’s buried in the terms and conditions and sounds like a complete backwards and low-tech process involving sending e-mails and forms and waiting for them to e-mail you back a list of “available bars” (you can’t make this up). It also says that you are “applying to redeem” which sounds distinctly like they can “reject” your “application” for any reason at any time and they even go so far as to say they will rob you of your redemption fee for a rejected application. I could not find anywhere in the terms that say what the redemption fee is.

-

Wow look the fees. 1% per annum!. Plus, the token inflates to accomplish this. Imagine what a nightmare it is to price and track this! What Are The Fees Associated With DGLD? | DGLD

-

“Apply for a wallet”? That doesn’t sound very decentralized or blockchainy to me. In fact that sounds more like a bank account or a brokerage account.

-

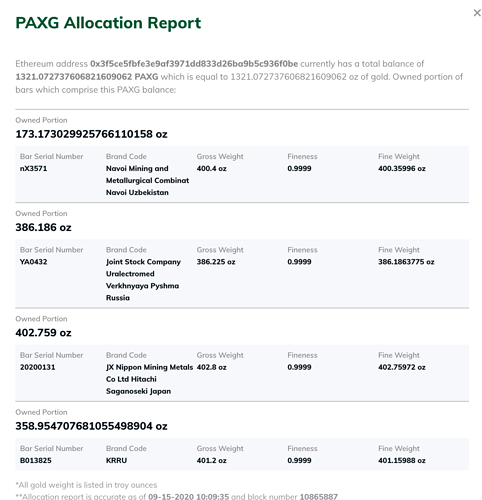

Where are the assets? Where is the list of the bars? What kind of bars are they? What is the minimum redemption? Is it 430 troy ounces like PAXG and XAUT?

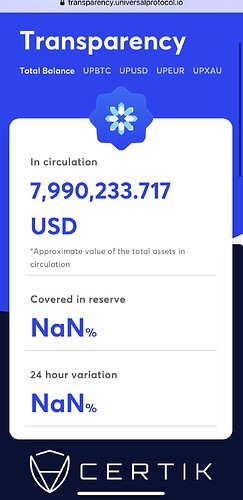

It is absurd to even try to pass this token off as being anything like the others, it has almost nothing in common with any of them other than the claim that it is some kind of digital token that is backed by gold. It also has the worst imaginable design and seems to be the least transparent (even worse than Tether). I am stunned at how poorly designed this token is. It has the opposite of almost everything I would want in a gold token.