Summary:

With CIP#7 and #9 (50% admin fee on existing trading fees to be distributed as CRV) receiving a lot of support, we would like to propose the admin fee to be implemented on one or multiple pools.

If there is sufficient support for one of those two options, a DAO vote will created and will be subsequently implemented

Implementation:

The steps will be:

- Signalling vote on implementation of a new admin fee - Success

- Signalling vote on how those fees should be distributed - Success

- Signalling vote on which pools will receive the admin fee <== We are here

- On-chain vote: Admin fee implementation on DAO

Options:

- Y Pool

- sUSD Pool

- ren Pool

- sbtc Pool

- All Pools

The idea behind suggesting one pool and not all from the start would be to check the impact of halving fees for liquidity providers to direct it to veCRV holders.

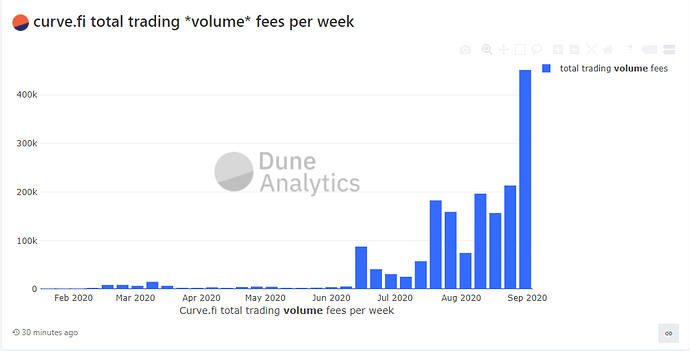

Based on recent volumes this proposal could distributed over $10M per year in trading fees alone to governance participants before even considering gauge withdrawal admin fees.

As a reminder, this would not change the trading fee (0.04%).

Poll: