Summary:

In cbETH pool we experiment with liquidity parameters with results applicable to not only staking derivatives, but also possibly forex markets, wrapped veCRVs and chicken bonds (aka bLUSD).

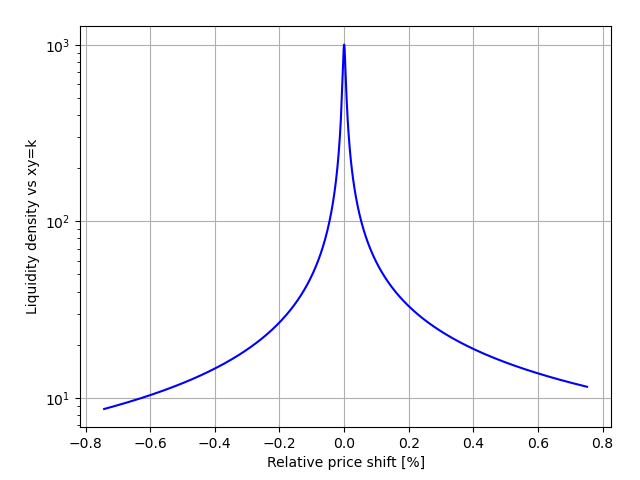

In previous iterations we have changed liquidity density of cbETH pool, and it seems to be still adjusting the price with that:

In brief, liquidity density is better than in xyk pools by factor of 10 if the price is different from the dynamic peg by 0.6%, by factor of 50 if by 0.1%, and by factor of 500 if exactly on peg.

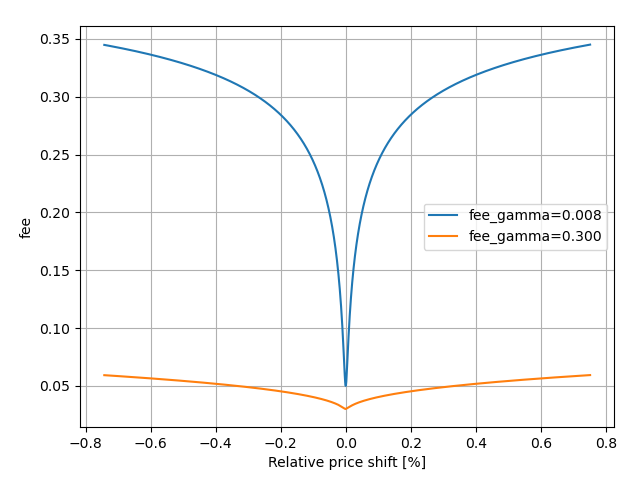

While this sounds quite good, effect of this concentrated liquidity is greatly negated by high fees. We propose parameters to have the fee no greater than 0.05% if the price is within +/- 0.3% range from the peg.

Motivation:

Make fees competitive while liquidity density is high

Specification:

Parameters necessary for the change are:

mid_fee = 0.03% (down from 0.05%)

out_fee = 0.45% (same as now)

fee_gamma = 0.3 (in comparison with current 0.008)