Summary:

This is a Gauge vote and Parameter update for the TryLSD Pool with bluechip Liquid staking derivatives (LSDs): wstETH, rETH, and sfrxETH. The goal is to generate extra volume and TVL for the Curve ecosystem.

LSDs are becoming increasingly popular on the Ethereum blockchain. There are over 60 types of LSDs, and the main blue-chip LSDs take up a significant percentage of the LSD market. Although there is still a low volume between different LSDs, we see an increased volume in the future when the competition becomes more intense. This pool starts on Ethereum L1, where people can wrap and unwrap the LSDs, but we also have plans to expand this pool to different L2s. Having a good LSD pool on Curve will generate extra volume and TVL for the overall Curve ecosystem.

The 3rd largest Balancer pool is an LSD pool. This LSD pool has 4BPS fees. Together with NagaKing, we have created simulations and updated parameters to offer a competitive, low-slippage LSD pool for Curve.

Proposed new parameters:

Old values:

A= 27000000

gamma= 20000000000000000 (0.02)

mid_fee= 1000000 (0.01%)

out_fee= 55000000 (0.55%)

fee_gamma= 2154434690031882 (0.002154434690031882)

allowed_extra_profit= 2000000000000 (0.000002; tricrypto default)

adjustment_step= 490000000000000 (.00049; tricrypto default)

ma_time= 600 (tricrypto default)

New Values:

A= 270000000

gamma= 19000000000000000 (0.019)

mid_fee= 1000000 (0.01%)

out_fee= 20000000 (0.2%)

fee_gamma= 220000000000000000 (0.22)

allowed_extra_profit= 2000000000000 (0.000002; unchanged)

adjustment_step= 490000000000000 (.00049; unchanged)

ma_time= 3600 (1 hour)

References/Useful links:

TryLSD Pool: https://curve.fi/#/ethereum/pools/factory-tricrypto-14/

Balancer LSD Pool: 0x42ed016f826165c2e5976fe5bc3df540c5ad0af700000000000000000000058b

wstETH: 0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0

rETH: 0xae78736cd615f374d3085123a210448e74fc6393

sfrxETH: 0xac3E018457B222d93114458476f3E3416Abbe38F

Motivation:

TryLSD TVL and volume has been low, and adding a Gauge would boost TVL growth and divert more volume toward the TryLSD pool. Having an efficient LSD pool on Curve will generate additional volume and TVL for the broader Curve ecosystem.

The parameters have been revised so that the Curve TryLSD pool can consistently offer a 1-5 BPS fee, making it more competitive compared to the Balancer pool, which has a 4BPS fee.

See Below for Open Votes: Your Vote Would Be Greatly Appreciated.

Add Gauge TryLSD:

https://dao.curve.fi/vote/ownership/450

Update Parameters TryLSD:

https://dao.curve.fi/vote/ownership/448

Parameter Selection

The proposed parameters are designed to reduce trading fees and increase liquidity density (i.e., reduce slippage). Currently, the pool’s fee parameters are overly sensitive to pool imbalance, resulting in uncompetitive fees. For example, the pool currently has a fee of 40 bps (10x the target fee range) with only moderate imbalance. We simulated a range of parameters expected to produce average fees on the order of 3-4 bps and compared their performance.

TL;DR:

The selected parameters reduce fees and increase overall liquidity density and volume by:

– increasing fee gamma and reducing out_fee (producing more gradual fee increases with pool imbalance)

– increasing A (increasing liquidity density / decreasing slippage)

– increasing ma_half_time (reducing pool re-pegging to transient de-pegs)

See here the data plots used to draw our conclusions and parameters:

Summary Metrics: https://app.yieldnest.finance/tryLSD_ma_range.html

Heatmaps: https://app.yieldnest.finance/tryLSD_heatmap.html

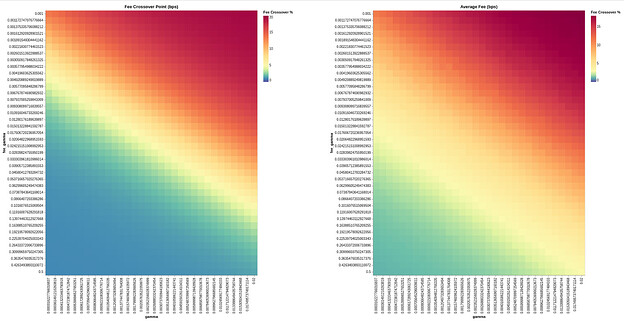

Fee Optimization

We simulated a range of gamma/fee_gamma parameters, focusing on parameter combinations expected to produce a maximum fee of ~5 bps, while holding out_fee (20 bps) and A (270,000,000) constant. With mid_fee held constant at 1 bps, a max fee of 5 bps would produce a typical fee around 3 bps. The max effective fee was estimated by finding the point where change in price (% from price_scale) was equal to percent fee (left plot). The 5 bps target is represented by the yellow diagonal band. After simulating, we plotted the average fee (right plot) and verified that the targeted fee range was indeed observed.

https://app.yieldnest.finance/tryLSD_heatmap.html

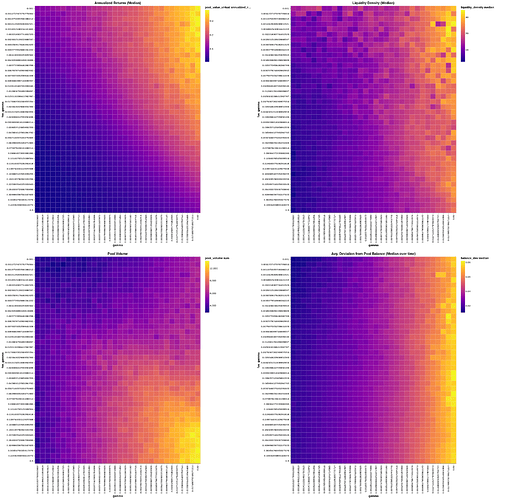

Gamma/Fee_gamma Selection

We compared annualized returns, liquidity density, trading volume, and pool balance for each gamma/fee_gamma combination.

While annualized returns and liquidity density were maximized for the values in the upper right corner (high gamma, low fee gamma), this was driven by rare, high fee trades during transient depegs (average fee 16-18 bps), rather than consistent trading within typical price ranges. For these parameters, the higher liquidity density was driven by prohibitively high fees for off-balance trades, preventing traders from imbalancing the pool. Thus, the high liquidity density came at the expense of limited trading volume (see lower-left plot).

Because this resulted in poor trading experience and high fees the majority of the time, we ruled out these parameters and focused on the lower-right corner (high gamma, high fee gamma), where average fees were far lower (2-7 bps), and volume was approximately doubled.

https://app.yieldnest.finance/tryLSD_heatmap.html

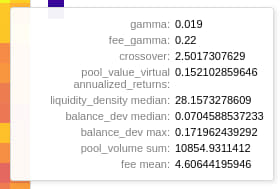

Simulating the lower-right, high-volume region with finer resolution, we found a region that seemed to optimize best the trade-offs between returns (est. ~15% annualized), liquidity density (median ~28), volume (~11k ETH for full simulation period) and pool balance (median deviation 7 percentage points from optimal 33/33/33 split). Mean fee was 4.6 bps, slightly higher than our target. However, closer inspection revealed that most trades had a fee < 4bps, and a few large outliers dragged the average fee up. Therefore, we ruled the fee range to be acceptable.

https://app.yieldnest.finance/tryLSD_heatmap.html

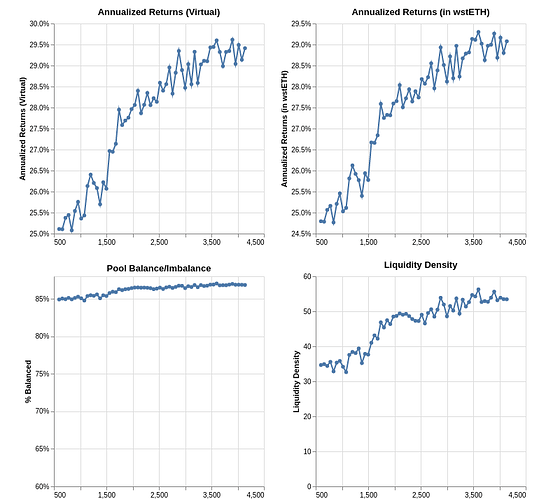

Optimizing ma_half_time

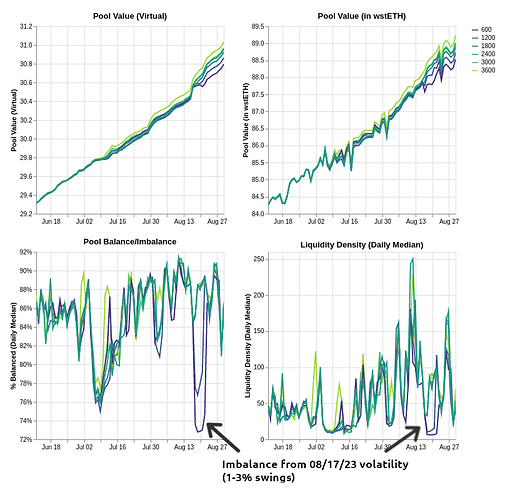

Because the LSDs of interest retain fairly stable prices, with occasional transient shocks of 1-3% down, we considered whether a longer price oracle moving-average would improve performance by stabilizing the pool’s peg (i.e., the price_scale). Using the abovementioned parameters, we examined a range of moving average durations and found that 1-hr moving average half-time (x-axis, 3600 seconds) improved pool performance considerably.

https://app.yieldnest.finance/tryLSD_ma_range.html

With the longer MA half-time, the pool was better able to handle and recover from transient price shocks:

https://app.yieldnest.finance/tryLSD_ma_range.htmlThus, the longer MA half-time improved performance across all metrics.