This proposal was first posted on Oct 23; this is a revised and updated version, accounting for the additional third-party reviews available, one additional month of protocol data, and communicating better on the risk model of Chicken Bonds.

Summary

Liquity launched Chicken Bonds on Oct 04, a product offering new yield opportunities on LUSD while enabling the protocol to capture POL in the LUSD/3crv pool. bLUSD is an auto-compounding, yield-amplified, LUSD-backed ERC20 token with a rising floor price.

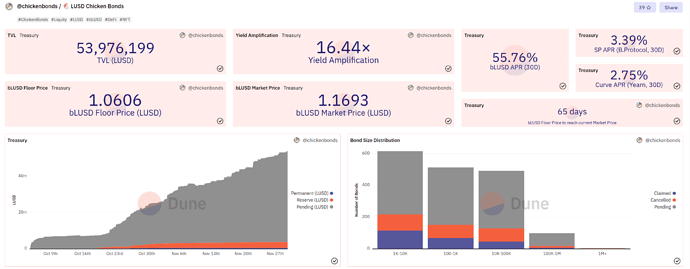

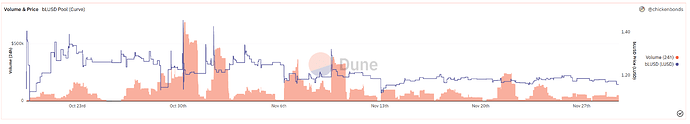

The bLUSD/LUSD-3crv pool is critical to the system, which incentivizes it in LUSD. Within the first few days, it already grew to >$2M deposited, with now about $5M TVL. Adding the bLUSD/LUSD-3crv pool to the gauge controller will help the bLUSD pool to attract further liquidity as it enables users to assign a gauge weight and mint CRV.

References

- Website – https://chickenbonds.org/

- Documentation – Table of content - LUSD Chicken Bonds

- Twitter – https://twitter.com/chickenbonds

- Discord – Liquity

- Dune Analytics – https://dune.com/nemoventures/chicken-bonds

- Security Audits – https://liquity.gitbook.io/chicken-bonds/documentation/technical-resources#security-audits

Protocol Description

Chicken Bonds are a new experiment pioneering dynamic NFTs evolving based on the user’s interactions helping Liquity grow LUSD’s liquidity and reduce the stablecoin premium. Right now, it’s a layer built on top of LUSD and Liquity.

It translates into new and attractive yield-earning opportunities for LUSD holders. As they interact with the protocol, a permanent reserve of LUSD is captured and can be deployed into the LUSD/3crv pool if LUSD trades at a premium (shifting function).

If successful, the Chicken Bonds model can be further generalized to accept any kind of LP tokens.

Chicken Bonds are an engine made to capture and support liquidity over time. The LUSD Chicken Bonds instance was launched on Oct 04. It attracted >50M LUSD since then, spread over >1 600 bonds. On Oct 19, the first bonds were claimed, and the bLUSD LP started to be supplied. The Chicken Bonds went through a ramping-up phase now over:

- Nov 04 (30 days post-launch): redemption became possible. With redemptions, bLUSD holders can burn their token to recoup a share (at pro-rata) of the LUSD balance in the Reserve.

- Nov 19 (45 days post launch): the shifting function became triggerable, meaning that the Permanent Bucket balance can be deployed to the LUSD/3crv pool, and it was, with about 500K LUSD supplied.

Motivation

The Liquity protocol is deeply intertwined with Curve Finance, as the LUSD/3crv pool has been the main trading venue for most of LUSD’s existence.

The arrival of the Chicken Bonds marks another milestone in the two projects’ collaborations, as the bLUSD/LUSD-3crv LP is an essential component of the system — which has a built-in mechanism to incentivize the pool (3% Chicken In fee).

Suppose the LUSD Chicken Bonds prove successful over time in growing LUSD liquidity and improving its peg. In that case, many other projects will be happy to harness the Chicken Bonds model. Each instance has its Curve pool with a native, built-in, and compelling incentivization model in the current design. Thus the bLUSD pool might be just the first of many.

Note: With Chicken Bonds, it’s also the first time in Curve’s history that dynamic NFT-reward are allocated to veCRV gauge voters! Indeed, veCRV voters for the LUSD/3crv pool obtain a bonus attribute on their Chicken Bonds NFT: a Llama, of course! Check here to see what that looks like on the NFT.

Specifications

Governance

Just like Liquity, Chicken Bonds is an immutable system that has no governance (except emergency function described below). Similarly to Liquity too, they are built to maximize trustlessness and decentralization. Chicken Bonds rely on third-party protocols for the yield and compounding (B.Protocol, Yearn, and Curve); thus they imply slightly more trust than the main Liquity protocol, on top of the added smart contract risks (audited).

There is an emergency shutdown function built in, triggerable by Yearn DAO. It makes all of the assets contained in the Chicken Bonds redeemable for the users allowing for a graceful unwind if needs to be.

Oracles

Chicken Bonds do not require any oracle. The bLUSD Curve pool is the main market price source for bLUSD. B protocol used to settle LQTY and ETH farmed does require a price source.

Audits

Multiple security audits were conducted by various auditors, as well as economic modeling. All relevant documents are available here: Technical Resources - LUSD Chicken Bonds

Centralization Vectors

Liquity has deployed an immutable and finished system which can’t be changed. There is only one potential centralization vector here, the emergency shutdown function. However it poses no risks to the users assets, as it simply pauses the system and allow every participant to withdraw their assets either through Chicken Outs or redemptions. Yearn can triggers the graceful unwind function if needed.

Apart from that, smart contract related risks, potential economical attacks, users are exposed to risks stemming from two key integrations harnessed by LUSD Chicken Bonds.

-

Bprotocol: [Potential “rug” of unharvested LQTY yield so far] BProtocol can update LQTY seller and steal LQTY that has not been harvested - assuming the multisig has been compromised. 2/3 multisig + 24h timelock.

-

Yearn Finance related risks, used by the Permanent bucket only, when LUSD is trading at a premium.

-

Yearn has full control over all funds allocated to their vault (6/8 multisig, no timelock).

-

Yearn can trigger migration whenever they want and potentially cause some issues (no further LUSD sent to the Curve pool, etc.)

-

There are more subtle attacks like removing the strategy from Yearn’s withdrawal queue blocking the shifting back to the stability pool. It can be performed by the strategists’ multisig, (3/9 multisig and does not need to go via governance).

Market History

Thanks to the Chicken In incentive, LPs are earning ~5-10% APR in LUSD. bLUSD has been claimable since Oct 19, so its market history is still relatively short. However, about $5M of assets have already been deposited into the bLUSD/LUSD-3CRV pool.

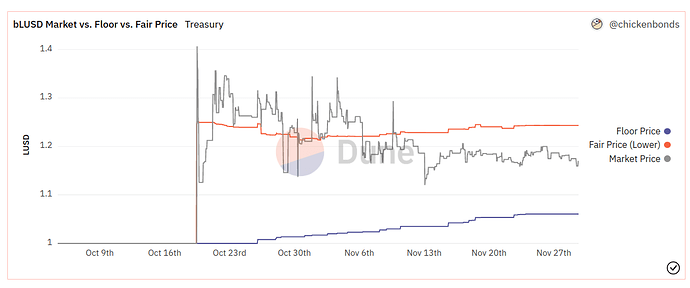

So far, bLUSD has been trading most of the time around 1.2 LUSD. The redemption mechanism guarantees a rising floor price for bLUSD against LUSD thanks to the yield generated by the protocol (currently 1.0605). Thus bLUSD trades in a range over LUSD’s price, with fluctuations depending on the users decisions and timing.

A historical bLUSD price chart can be found here: https://dune.com/chickenbonds/lusd

As the LUSD Chicken Bonds mature, more bLUSD will exist, driving the need for more liquidity. The current balance is already quite healthy since about ⅔ of the bLUSD in existence are supplied to the Curve pool (2/3M).

Independent Review

The CryptoRiskAssessments team has reviewed the Chicken Bond:

Asset Risk Assessment: Liquity Chicken Bonds

Resources to deep dive into Chicken Bonds

Here are some articles to help you learn more about LUSD Chicken Bonds:

- High-level overview: how can Chicken Bonds help solve the DeFi’s liquidity challenge.

- Game of Chickens! The end of the bootstrap period and what it means for bLUSD — to better understand the dynamic of the bootstrap and the bLUSD pool structure.

- NFT x DeFi: Deep dive into LUSD Chicken Bonds’ Dynamic NFT — for more information on the Chicken Bonds NFTs.