That was not a governance attack sir. Mochi’s story began with a lax granting of their gauge by the Curve and greater Curve communities. It ended as YettyWapp outlined above.

The whole point of this gauge proposal is to incentivize deeper liquidity for sdCRV. Any argument that dismisses attack risk because of sdCRV’s currently low liquidity is disingenuous.

Gm,

This is the current state your describing, we have to think about in the future as well. It may be financially inefficient now, but in the future it could be efficient to do so.

The plausible solution to this proposal is creating a lock of sdCRV for a certain amount of time. vlCVX is 16 weeks, follow a similar route as c2tp mentioned.

So discussion looks not about sdCRV, sdFXS, sdAngle gauges and not how to protect Curve from gov attack. Discussion looks like how to protect Convex monopoly. sdCRV already exist and sdCRV-CRV liquidity already exist to make fair competition between cvxCRV (cvxFXS) and sdCRV (sdFXS) Curve need gauges for both or no gauges for both (also this make sense for CVX). So what about to kill gauges for cvxCRV and CVX or if it is dangerous for Convex monopoly is prohibited? Why even cvxCRV (CVX) need incentives at the moment? More than 50% of veCRV under cvxCRV (CVX) and future incentives dont make sense to me.

I do not agree with this.

The sdCRV will participate in locking up even more CRV and we can expect the price of CRV to continue to rise, making governance attacks even more expensive.

Furthermore, unlike on Convex, holders (overall DAO’s) will not have to dump their CRV for CVX to get voting power. This is another argument for bullish pressure on the crv and thus ultimately to keep the risk of an attack even further away.

By the way, the 4 months lock for vlcvx, did not prevent the Mochi’s attack.

Checked multiple messages raising governance attack concerns.

I think, at this point, flash loan attack is hardly possible simply because total veCRV is so much larger than the available CRV liquidity. However, what is the concern is misaligned (short-term) incentives: imagine a decision which can allow to take a short-term profit (like, “turn CRV into a ponzi”), take profit and leave when it maxes out (in a couple of months).

This is why veCRV has 4 years locktime in the first place. vlCVX seems to be not protecting against this sort of attack (though it has the veto kind of mitigation), and veSDT which boosts the voting power does have multi-year lockup.

So if anything, for practically relevant attacks, veSDT seems to be better protected. And, therefore, I’d recommend voting for this proposal.

I just don’t get why sdCRV allows fully unlocked governance.

At the very least put in a 4 month lock on it OR start the veSDT boost multiplier from 0. I’d be in full support if either of these 2 changes were made.

This seems contradictory.

- veCRV was created to be locked.

- sdCRV is unlocked veCRV which would be rewarded by CRV emissions. In return making a more liquid unlocked governance token as more liquidity flows in to capture short term profits.

It does not make sense to reward unlocked veCRV since it circumvents the whole purpose of veCRV. People would be able to move in out and freely which would be a big slap in the face to the CRV lockers that went the veCRV route for its intended purposes.

- cvxCRV is liquid but just a claim on fees with no governance control.

- vlCVX has a lock and a governance attack seems near impossible at the current moment due to 80.37% of it being locked.

Why does sdCRV get to have no lock on such a crucial component/mechanism of Curve? Why have a veCRV lock in the first place then?

- Should Convex remove its locking time on vlCVX to keep up with the proposed changes to the rules of the game?

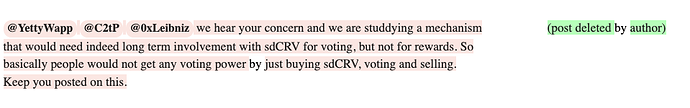

this was also mentioned by @Tube, but deleted? But this seems like a more proper route imo. Not sure why it was deleted.

I am an early Curve user and supporter. I had the faith in you, the rest of the team, AND the protocol to lock a large pile of CRV for 4 years for yield and governance rights.

I agree with Yetty Wapp. To allow sdCRV governance rights without a lockup is a slap in the face to supporters who had faith in the protocol to lock from day 1. I have no problem with a liquidity wrapper like cvxCRV or sdCRV. However, I believe governance rights should be subject to a lock up like every other user, including Convex’s 4 month locks. I support a lockup for sdCRV to align their users’ best interests with the Curve Protocol.

Hey everyone,

I just wanted to give my own 2 cents (or .02 FRAX) feedback from the Frax side of things. I had extensive discussions both with Stake DAO team and Convex/c2tp about a lot of this stuff. At FRAX, we have a great relationship with Curve, Convex, Stake DAO, and many protocols we work closely with. Stake DAO & Convex are one of the few teams that have an FXS whitelist as well as a CRV whitelist.

I personally won’t comment on the sdCRV-CRV pool as I do not think it is my place since FRAX does not have a large veCRV position (because we literally cannot), but I did want to comment on the sdFXS-FXS gauge proposal since we are the largest protocol holder of vlCVX and thus will have a direct say in the vote through Convex.

FRAX generally supports the sdFXS-FXS gauge. I like the idea overall and think even though there is some valid input from c2tp, it is fine moving forward with the sdFXS-FXS gauge in my opinion. However, I think we should definitely address the locking aspect as I think it is a very reasonable point. Some ideas I have (which I propose for sdFXS-FXS specifically, it does not need to apply to the CRV product):

1.) Can Stake DAO explore potentially making it so that the sdFXS-FXS LP token requires locking for 16 weeks similar to vlCVX in order to participate in FXS governance? Then the LP token’s balance can be used for voting with Stake DAO’s veFXS stake. That would continue to make sdFXS competitive in the FXS derivatives landscape and address the “skin in the game” issues that have been brought up.

2.) Can Stake DAO work with the FRAX team to continue to see how this new product behaves and if there are adverse effects on Frax governance economics to address them with new sdFXS features so that it does not become a systemic risk that grows bigger over time?

If the answer to both of the above is yes, then I am bullish. I hope this was helpful feedback ![]() Overall we like the sdFXS product and where it’s going.

Overall we like the sdFXS product and where it’s going.

-Sam

Initial big slap in the face to the CRV lockers that went the veCRV route for its intend purpose was made not by StakeDAO. Some of community members believe that CVX (vlCVX) broke initial veCRV lock idea. After one year the risk for Curve to become a Convex subDAO is extremely high. Of course remove locking time for vlCVX is greate idea to protect Convex monopoly and make Curve a Convex subdao forever.

vlCVX has a lock of 4 months and is not a liquid veCRV token.

So CVX (vlCVX) being a slap in the face doesn’t quite compare to sdCRV.

Per Sams comment

initial veCRV has a lock 4 years. It is no brainer that after CVX was deployed motivation to lock CRV for veCRV for average Joe for 4 years was destroyed

CRV can be locked for 1-4 years. 4 years is optional. 4 months is quite a large amount of time as well. Sure not every 1-4 year veCRV locker would be happy with that. The point is, vlCVX HAS a lock. sdCRV would NOT have one at all per this proposal.

At least match vlCVX or some time period. Its really simple, add an amendment to the proposal introducing a lock and I have no issues with the proposal.

sdCRV already exist and this proposal not about sdCRV itself, this proposal about sdCRV, sdFXS, sdANgle gauges. It so disappointing to see how Convex supporters trying to put pressure on StakeDAO to create the picture that what good for Convex is good for Curve

You are side stepping the whole point of sdCRV not being locked and the gauge creating deeper liquidity for an unlocked governance token via CRV emissions. This defeats the purpose of veCRV and makes me question why Convex should even keep their lock now, if this proposals passes as is.

I am a native Curve (CRV) locker and user and have regular veCRV as well. So yea.

Sir with big respect to your opinion, I cant change my own. I support this proposal and believe that in current state sdCRV, sdFXS, sdAngle are great products and need gauges for fair competition and this will be benefit Curve ecosystem. On sdCRV itself I can say again. Full potential of voting power of sdCRV is open just with 4 years locked veSDT, without locked veSDT you sdCRV voting power is partly diluted. I can easy imagine (predict) the future high SDT price and how difficult will be to unlock full sdCRV voting power for reasonable size sdCRV position. I am as you CRV-veCRV locker and user from early days, additional I have my stakes in yveCRV(yvBoost), sdveCRV-sdCRV, vlCVX, and I am trying to look on this from general interest of Curve.

My points are all laid out already.

My opinion (and many others) is lock it up and there is no issue.

I dont have any power (do not count my farmed SDT and the power to vote on StakeDAO gov) to change sdCRV. But as Curve community member I believe that sdCRV, sdFXS, sdAngle create value for Curve as is, so I am For