Service tweet, the vote is live:

Not sure if mentioned already and I expect this is common knowledge, but worth mentioning anyways. There is no guarantee that liquid veCRV will stay on peg or even that there will continue to be adequate liquidity back to CRV. If such positions are being held temporarily to earn some yield, there is a possibility that Swiss Stake will have to sell at a loss that exceeds yield earnings.

If Swiss Stake thinks it can pay all its expenses from veCRV yield and will never need to sell the liquid lockers, I have no problem. But if the plan is to juice some yield for 6 months and sell, I would rather Swiss Stake not mess around with those at all and just liquidate the CRV on a regular schedule.

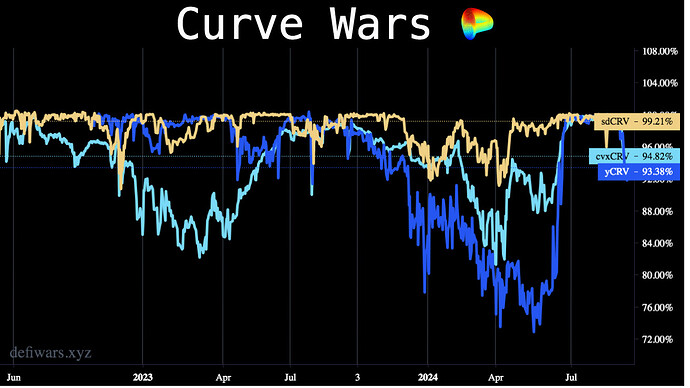

That’s a good comment, all depends on the yield tbh. Currently, the yield of wrappers is super low because of low crvUSD revenues and low bribes, but for the past 12 months it was sitting around 20% for the lowest up to 40-50% for the highest solutions. If we take the example of asdCRV, for the largest part of last year 1 week of yield was basically offsetting a potential 1% depeg. Since the biggest depeg ever seen on sdCRV was 92% iirc, it means you can always get your position back by staking 2 months. And those depegs never last long.

However, past performance is no relevant information to assess future performance, I give you that.