At the beginning of this week, we published the draft grant request for Swiss Stake AG. We greatly appreciate the valuable feedback from the community. As a committed, reliable, and long-term contributor to the Curve project, we remain fully dedicated to developing advanced, first-class technology.

We take your feedback seriously and have addressed the most critical concerns raised by the community in this update. We are confident that this additional information will help you make an informed decision when voting. The proposal will be put to a vote later this week.

Once again, we deeply value your ongoing trust and support as we continue our work.

Thank you!

What is the grant going to be spent on?

We plan on developing and delivering a series of revolutionary technical features to be added to the Curve project software repositories. This includes:

-

Technology which allows automatically scaling supply sinks for crvUSD such as staked crvUSD. This will also be made portable to other (even non-EVM) chains.

-

Code to enable more collaterals for crvUSD such as LP tokens of Curve pools. Curve benefits from this enhanced capital efficiency, allowing liquidity to be utilized more effectively.

-

Code for two-way lending markets (e.g. markets where one can borrow against collateral which can be borrowed itself).

-

Code for multi-market semi-isolated lending.

-

Enabling cryptoswap algorithm to be well integrated with crvUSD to allow for much more efficient forex pools. That also needs provision of the technical basis for non-USD variants of crvUSD.

-

Enabling DAO cross-chain functionality (starting with boosts for pools deployed on non-Ethereum chains).

-

We are planning on improving and transforming the UI/UX interface and experience, all code will be open source.

-

Reworking governance site (e.g. dao.curve.fi), all code will be open source.

Optimized use of grants

We understand the importance of developing a sustainable business model that minimizes or ideally eliminates the need for future grant requests. Over the next 12 months, we will be actively working on this and will keep the community informed of our progress.

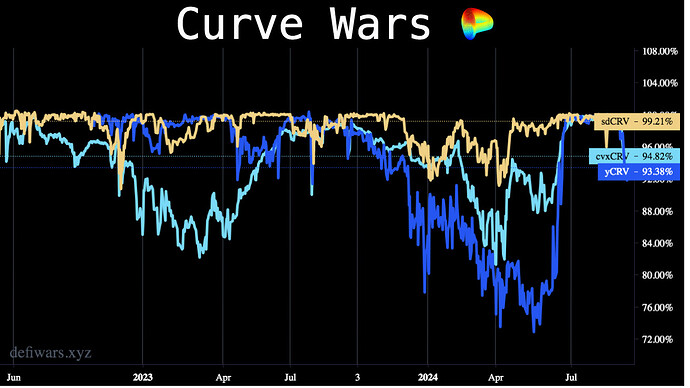

Furthermore, we are dedicated to use and spend the grant in a responsible and sustainable manner. Swiss Stake AG will stake the CRV received as part of the grant (and which are not immediately needed) with major liquid locker projects (such as e.g. Convex, StakeDAO, Yearn).

We acknowledge that continued funding is not guaranteed, and we remain committed to demonstrating our value alongside other organizations working toward similar goals.

Community Updates & Reporting

Swiss Stake AG will allocate the entire grant strictly according to the purposes outlined here. If any funds remain unspent within the next 12 months, these residual amounts will be rolled over into the next period.

We are committed to providing the community with regular updates on the status and progress of all technical features. Additionally, we will track and report the expenditure of funds across the following categories: 1) Security Audits, 2) Front-End Development, 3) Software Development, 4) Infrastructure, 5) Community & Tech Support, and 6) Research & Analytics. These reports will be made available to the community on a quarterly basis through the governance forum.

Vesting to a smart contract

Over one year, CRV tokens will be vested to a smart contract, from which Swiss Stake AG multisig can withdraw the CRV. In a dispute, Curve DAO can disable withdrawal for the multisig, then either re-enable it or send the CRV token back to the community funds.