Summary:

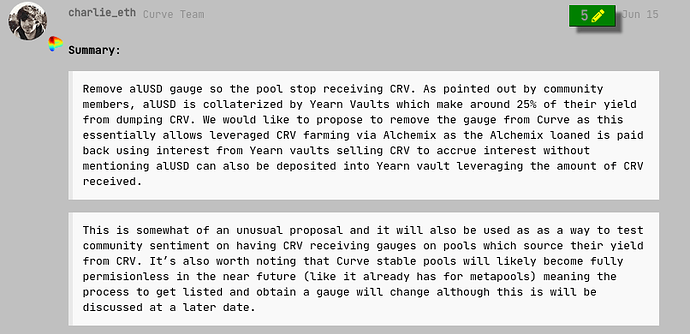

There is community pushback to the dumping of CRV which has created a drive to develop ways to reduce (in some cases eliminate) incentives on specific pools.

While CRV dumping is a topic which is certainly up for robust discussion, the proposed routes to reduce leveraged dumping are ineffective and therefore we should consider carefully if there are any benefits at all to implementing restrictions to these pools.

Defining Double Dipping:

We cannot begin to address Double Dipping unless we define it. I believe I can safely summarize

Double Dipping is leveraged CRV farming

In such a mechanism there are multiple parts.

Vault

In this context, a Vault holds a users liquidity, provides it to Curve, Deposits in Gauges, earns CRV rewards, and sells those rewards for more underlying liquidity.

Collateral

Common implementation is the collateral is a wrapped Vault in which the wrapper grants the ability to draw debt

Debt

Common implementation the debt asset is fungible and unrelated to the Collateralized Debt Position. Holders of this debt note may not have a CDP at all. CDP holders may spend it on other things, such as the famous alUSD boat.

Collateral Ratio

Common implementation provides a limit to the amount of debt that can be drawn against a given collateral. At 50% you can approach 2x exposure. At 95% you can get quite a bit more. The higher the Collateral Ratio, the more an individual user can leverage loop.

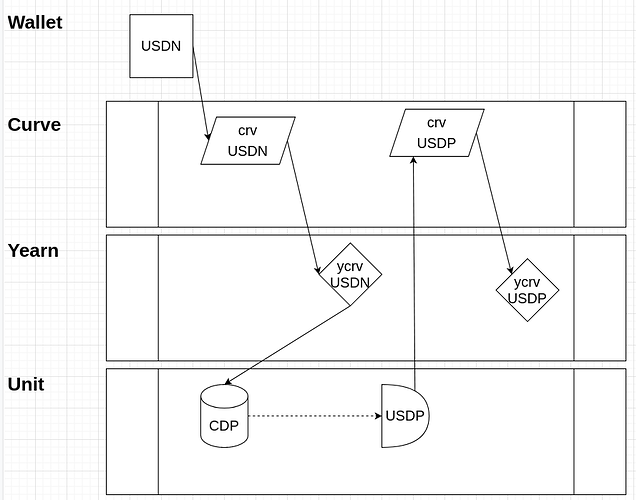

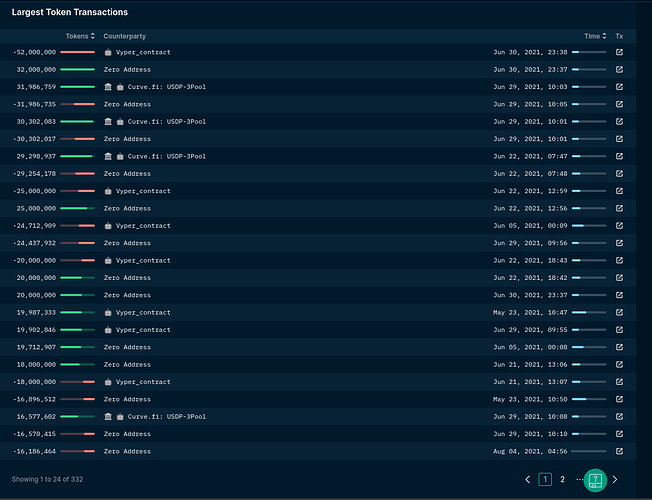

Leverage Looping in Action (1 loop)

- Supply liquidity to Collateral Vault. (dumps crv)

- Draw debt

- Deposit debt to debt token curve pool, earn CRV or dump

Notice how it terminates at USDP since ycrvUSDP can’t be used as collateral

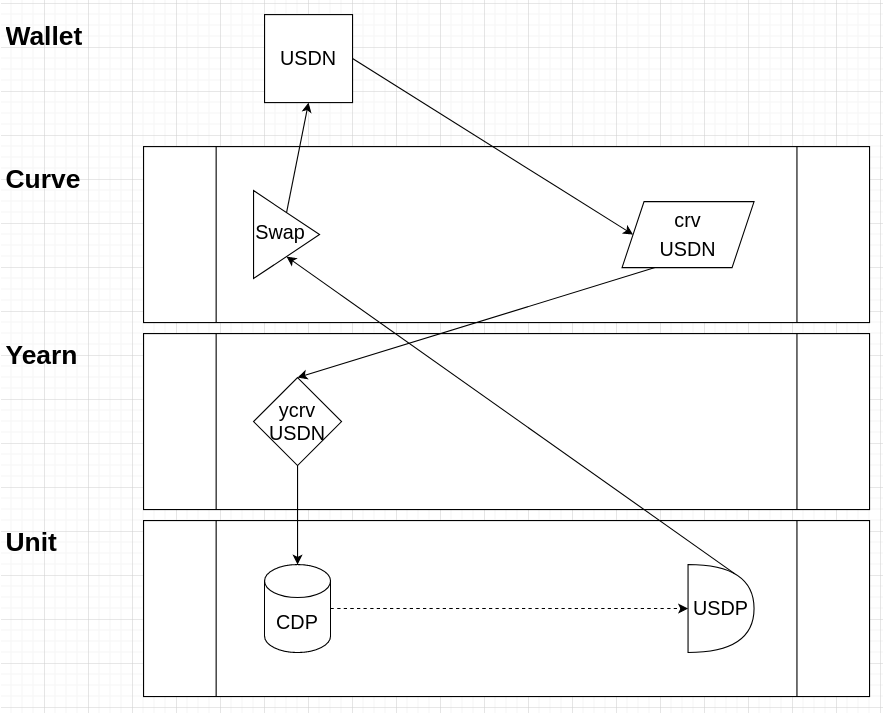

Leverage Looping in Action (2 loops)

- Supply liquidity to Collateral Vault. (dumps crv)

- Draw debt

- Swap debt token for asset that can be used in Collateral Vault

- Deposit any valid collateral asset in a Collateral Vault. (dumps crv)

- Repeat till you cant.

Notice how it loops back through USDN which can be used as additional collateral for further leverage.

Key Points

- All users are earning CRV rewards in proportion to liquidity provided.

- Some users are using their liquidity as collateral to draw liquid debt

- Some portion of those users are using that liquid debt to provide more liquidity to Curve.

- Protocols which provide a higher debt to collateral ratio allow for deeper leverage.

- The collateral is what is earning rewards, not the debt token.

- I repeat the debt token is not earning rewards

The Debt Token Pool

Common implementations do not use their own debt notes as collateral vaults. So users holding a debt note token are often at a place where they can no longer loop. (though admittedly raw AMM positions are becoming more common in major debt protocols and Maker does use DAI in LPs)

As mentioned earlier, some users have famously bought boats, I know someone who bought a car with Alchemix debt. There are many people on the other side of such plays whom are not leverage farming at all who may simply wish to provide liquidity or make trades for these tokens on Curve.

Where’s the money?

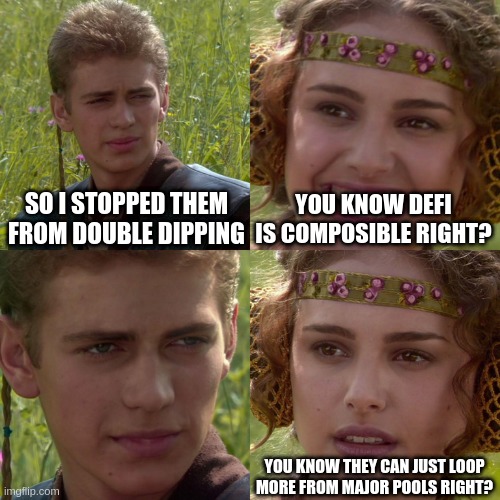

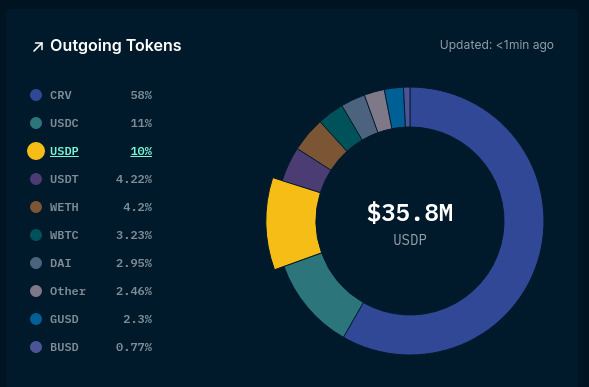

So we have established that its not the debt token that is dumping Curve, which means a user is free to trade that debt token for any asset which can be used as a collateral to maximize their leverage.

We have further established that there exists users who are not leverage looping who may be holding these tokens particularly because these debt tokens have no inherit leverage.

If the goal is to prevent double dipping, any move to limit the use of the debt token pool does not have an effect on the potential loops a user may enter, and at present may push them to pools which can be looped again several times over.

Once such Protocols exist the money can be in any asset so long as a vault exists which can be used as collateral.

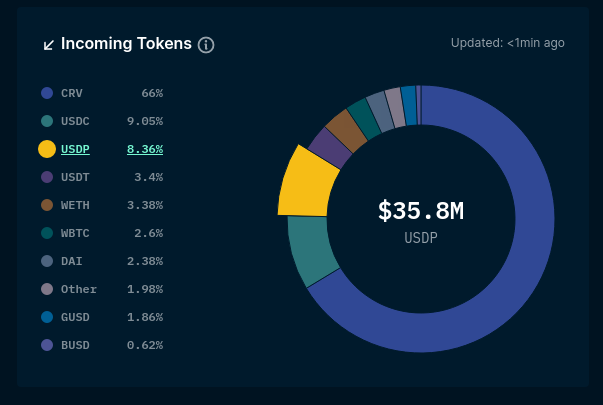

You can currently Double Dip the following assets

- DAI,

- USDT,

- USDC,

- USDN,

- FRAX,

- BUSD

- UST

- TUSD

- sUSD

- IB

Notably, you cannot Double dip from the starting position of

- alUSD

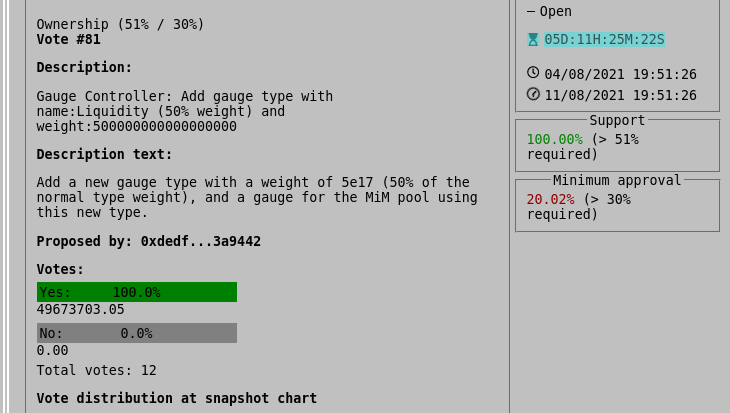

- MIM

- USDP

So if we are trying to stop double dipping by targeting the above pools, we are missing the forest for the trees. Literally community is seeking to reduce rewards for the set of assets which can’t initialize a Double Dip position, while all the assets that can are being left unhindered.

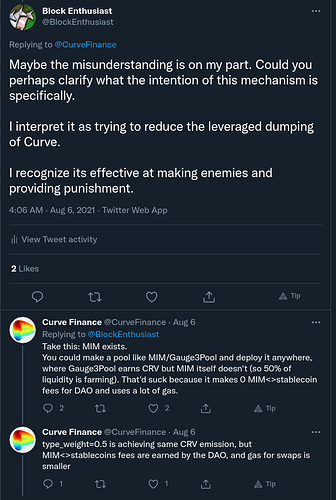

So what are we even doing here

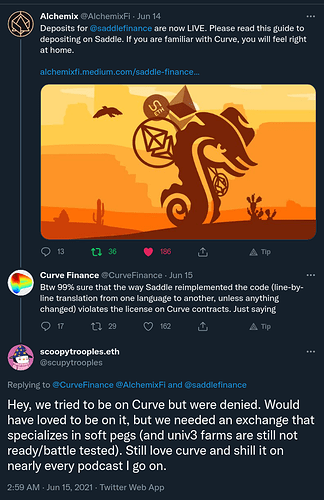

While protocols might not outright say it, lets put ourselves in their shoes. We are choosing not to incentivize their asset. If a competitor comes along who will, do you think they will exhibit loyalty?

No they’ll move liquidity to a place where they are being treated equally. Particularly because there is no clear justification to why except to show public disrespect to these pools as their liquidity is weighted less than “friendly assets”. If not a friendly asset, how should that be interpreted?

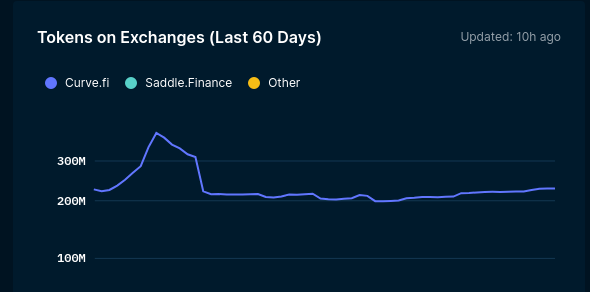

AlUSD liquidity was on the rise, with the 3rd or so highest Liquidity Utilization on June 14th. On June 15th, there was a proposal to delist their rewards. Liquidity started dropping that moment and has never returned, nor has the volume or fees.

It seems these measures may at best be incentivizing competition, and making allies feel unwelcomed, at worst costing CRV holders profits from the trading revenue these additional pools may generate.

- Lets reduce rewards for Double Dip protocol debt tokens

(BUT NOT REDUCE Double Dipping) - Lets have universal solutions which treat all liquidity equally

(since leverage is indistinguishable)

0 voters

edits

1-typo + add images

2-note images had slight issue

3-images replaced to include row for yearn