The pool has to be made fee-aware, that’s it

Regarding sXAU, my take is include it. I don’t think the risk of Synthetix blowing up is any greater than the risk that Tether or Paxos doesn’t really have the gold they say is backing the tokens (see https://cryptoresearch.report/crypto-research/discrepancies-identified-in-the-transparency-data-provided-by-pax-gold-and-tether-gold/). If Synthetix or Uphold would provide incentives - all the better.

I’m all for this proposal and it would be an awesome addition to curve pools, imo.

Honestly, I’m not sure. I simply don’t know the various ways that markets can be manipulated. My lockups are for 4 years and I have no personal interest in arbitrage. I’ve never taken a flash loan, nor do I have the skills for that either.

But warning lights go off for me when I see small markets, and all of these markets, even the Tether and Pax ones are so tiny that it seems like a distraction from the core business.

I think Curve needs to stay focused.

I could be swayed if there were some sort of incentive along the lines of the sBTC pool in which Synthetix/Ren/Balancer made that pool attractive for LPs.

XAUT should obviously be ignored because Tether is shady to say the least, and should be considered un-backed until proven otherwise.

At least the economics surrounding the sXAU derivative and the backing of its valuation are clear, while the 2 other tokens have credible physical gold backings.

So i’m in favor of a sXAU/PAXG/PGMT pool.

A pool being only as strong as its weakest token, I can say that if a gold pool is made including XAUT, i’ll personnally choose not to participate in it.

As for PGMT I find it funny to see it voted the least despite being what i think is the strongest Gold based token of the 4 by being directly insured by the Australian national mint (which is one of the major gold mints in the world) and having absolutely 0 fees.

Regarding the argument of “staying focused” , i’d say, if anything, it should apply first to all the existing -and incoming- USD pools…

I’m personally not interested in losing money with exposure to a depreciating USD and right now the only choice of non-USD pool is BTC.

So I think a gold pool would be a good thing, even it if it remains a marginal pool. As i understand it, being an easy bridge between similar stablecoins is the reason for this platform and there’s none for gold tokens right now… so its the perfect usecase for Curve.

Let’s just keep Tether out of it, no need for any additional risk on top of everything else.

Agreed on PGMT being severely undervalued here. We are already taking regulatory/institutional risk on USDC & wBTC in every pool we have. PGMT is the most credible gold token. Having sXAU offers a useful gateway into the Synth market and will make the pool have more functionality.

As for XAUT, if the ‘safe’ gold pool shows enough interest, we could consider a second pool that includes it at a later date. Especially when yield/collateral opportunities begin to open up for these tokens to a greater degree.

Who is going to bootstrap the pool? Each of us probably has a stack of one of the other, but i doubt anyone has all three or four in equal proportion and with 500 gas and poor liquidity on chain, somebody is going to take a beating being the first unless we agree to maybe trade privately and securely amongst ourselves beforehand to all equal up.

Continuing the discussion from [Discussion]Tokenised Gold Pool:

This is Dan from Universal Protocol; we’re thrilled to see a gold pool under discussion for Curve and would be honored to be included.

We’re extremely excited to support Curve’s gold pool, and UP would be happy to incentivize increased liquidity. We’ll kick around some numbers and put up a post with details, but we’d both incentivize the pool and likely a 95/5 Balancer pool for our ecosystem reward tokens to help with their liquidity.

We’re excited to see this happen; we’re big believers in gold-backed tokens and see the merits of a variety of approaches. Gold tokens are a great fit for Curve, given the relative stability of the asset suits the Curve formula, and there’s many market participants likely willing to warehouse gold risk in a similar manner as stablecoins. Looking forward to being involved, and happy to support and promote as we can. Cheers.

Can get in touch with us on Telegram.

We expect a soft vote giving a chance to governance participants to choose which tokens they would like to see in this pool to go ahead in the coming days.

We would like to suggest that you also include CACHE Gold (CGT) in the list above.

We have submitted a proposal to create a liquidity pool with CGT and also a Maker Collateral Onboarding Application for more information.

Without a storage fee and a transfer there are significant questions as to how a gold-backed token would be scalable and sustainable. Insured, audited storage will always have a cost. If gold-backed tokens don’t charge fees it raises questions about how they will pay these costs and what incentives they have to provide full backing. A transfer fee alone does not solve this problem because there would be no revenue if investors hold tokens for long periods of time without transferring them. A transfer fee could also be avoided by locking up the tokens inside a smart contract and then trading the ownership of the smart contract instead of transferring the tokens.

If Curve and other similar platforms want to deal with tokenized physicals assets, this is an important issue to consider.

@TwoCell, We may be willing to bootstrap a pool.

@Jon,

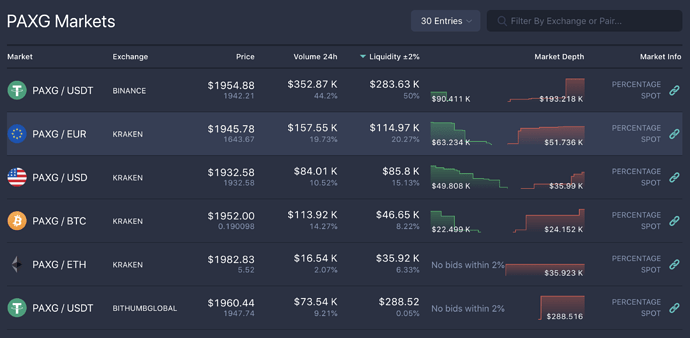

Agree with @Julian’s reply generally. However, large market caps do not make gold-backed tokens track the price of gold any better. Liquid markets do that and redemption provides an alternative if markets become illiquid or otherwise dysfunctional. Although PAX Gold clearly has the most listings and adoption so far, their markets tend to be illiquid and/or have asymmetric liquidity (more buys than sells or more sells than buys) and there is a huge range in price between different markets - currently $1,830 to $2,070. Redemption should provide an arbitrage opportunity but due to the high minimum redemption of 430 troy ounces, however it doesn’t seem possible to purchase 430 PAXG (~$832,000 USD at current gold spot) on any exchange at anywhere near the spot price.

IMO, sXAU should definitely be added to this hypothetical gold pool, even if the total market cap of sXAU is much smaller than the other gold-backed tokens. I suspect the reason why there is so few sXAU in circulation is because of the trouble in minting it (i.e.: one must acquire SNX, stake that SNX on the Synthetix platform to mint sUSD and finally exchange that sUSD for sXAU) and not because of the stability of the Synthetix platform.

Moreover, I’m personally inclined to trust in the value of sXAU more than others like XAUT, as the redemption process is on-chain (i.e.: one can exchange sXAU for sUSD on Synthetix with 0 slippage at the IRL rate) and the collateral backing sXAU is verifiable and transparent.

I really like the idea of combining of those types of digital gold (backed, synthetics, …). Even the output goldCRV token would be valuable as something you can put as collateral on other platforms (instead of under a mattress).

I also like the idea of a “WPaxG” although I don’t know if it solves all the fees-related issues nor if consulting Paxos first wouldn’t be better.

Formalisation of process starts now: CIP#12 - Which tokens should be included in a gold pool?

I think it’s a fair point that:

I would ask the audience here if Curve’s algorithm is likely to work better and earn more on:

- a large deep liquid market or

- a small shallow chunky one.

How about including Cache Gold? They seem to be the only one that has a real connection to the physical market, nice to know you can take delivery of your gold when fiat currencies/synthetics go to pieces

Any movement on this? I now there were concerns about the tiny market caps of each different type of gold token, but i was looking today and the market cap for paxg for example has increased markedly since this topic initially came up - I presume the others have seen similar growth. It would be nice to have more on chain liquidity in these tokens and be able to swap between them with no slippage since some are convertible to physical and some are not.

Hi Twocell,

You can read about the progress of CACHE Gold here: https://cache.gold/assets/docs/CACHE-Growth-Report-2021.pdf

We definitely have a working and efficient redemption system for bars as small as 100 grams.

Please let us know if you have any questions.

Yes, but only use PGMT and sAUX to begin with, then add others who prove to redeemable/liquid in the future.