Lots of good discussion here, I’m generally in agreement that this “double-dipping” concept isn’t the correct way to look at it - CRV gauge rewards are distributed according to amount of liquidity provided. As many others have mentioned, ALCX isn’t the only protocol performing leveraged CRV farming. Others have also brought up the point that the gauge pays out more in CRV rewards than we are receiving in trading fees (However this is true for the majority of pools across the board) This is a broader tokenomics issue that warrants its own discussion

We don’t currently, no.

@charlie_eth Any thoughts as to when this is going to go up on snapshot to measure sentiment from veCRV holders?

At present the Motivation and Summary are out of line with the Specification and that should either be noted in the original post or corrected before a vote.

Wouldn’t want voters making decisions under false pretenses that this Specification prevents double dipping, as implied by those sections.

Very healthy discussion (except for the unconstructive “dumb idea” type of comments), it’s nice to see.

I am very much in the camp that double-dipping is not really a thing as CRV rewards are a function of liquidity provided, as pointed out by @statelayer.

I also support the idea that we should let market forces decide on CRV reward allocation via gauge weight voting rather than trying to make governance favour/discriminate certain projects over others, like pointed out by @Globallager and several others.

I believe keeping a level playing field across participants should be an uttermost priority for building a successful, inclusive and sustainable DeFi ecosystem.

For that same reason, I also support @WormholeOracle proposal to put an alETH gauge to a vote.

veCRV $3CRV rewards are indirectly proportional to liquidity provided. If you keep and lock all your CRV rewards (which are proportional to liquidity provided), then your veCRV $3CRV rewards will also be proportional to liquidity provided.

CRV is a temporary incentive for the first 6 years of the protocol that gives the opportunity to LPs to participate in the governance (including voting on gauges) and retain a share of the trading fees generated by the protocol at perpetuity.

Then, it is a personal choice whether you believe keeping and locking those CRV to get involved in the governance and collect your share of $3CRV fees has value, or if you prefer to sell the CRV today for an immediate higher reward.

Having the $3CRV rewards proportionate to liquidity provided in a direct way would effectively mean removing the admin fee which act as an economic incentive for CRV holders to get more actively involved into the governance and also provide a stream of income for the long term sustainability of the protocol. In my view, our token/reward/incentive design works actually quite well.

There is a lot of lively discussion here which is nice to see.

The only thing I can add is that a primary driver for CRV token is to get widely distributed. Some will sell, some will HODL, some will stake. Curve has a big emissions rate but in the end if it distributes the token widely then Curve project will remain powerful and robust.

With veCRV $3CRV rewards being indirectly proportional to liquidity provided, but $3CRV fee-rewards coming in through trading volume, does that create the possibility of under-utilized (useless) liquidity? That is, one can suck down those sweet rewards by gaming the liquidity pools with liquidity that nobody uses (probably by using leverage).

I dont believe that this idea can be realized. Remember reasons for the failure of TradFI

Let me edit what I said earlier: veCRV $3CRV rewards are indirectly proportional to liquidity provided. If you keep and lock all your CRV rewards (which are proportional to liquidity provided), then your share of the veCRV $3CRV rewards will also be proportional to liquidity provided.

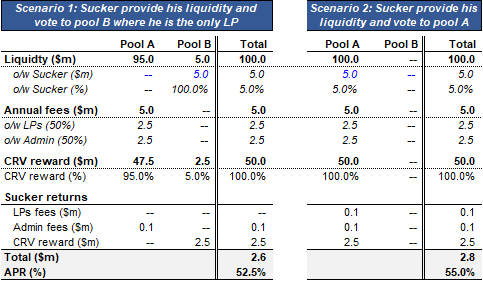

Gaming the system by providing liquidity to a pool that nobody uses with the sole intend to suck down CRV rewards would require a significant amount of voting power to allocate gauge weight to that pool + capital to commit to that pool. Everything else being equal, you are better off allocating your capital and vote to a pool that generate fees. See illustration below, assuming voting power (and share of admin fee) is proportional to liquidity provided. To keep thing simple, I assumed there were only two pools: pool A which generates $5m of annual trading fees and pool B which generate 0.