It needs gas like any token transfer but there is no additional fee in ETH.

Can you come for a chat on Telegram?

@cache.gold Congrats guys - it’s a great approach and am glad for projects that continue to build the tokenised gold ecosystem (in the proper way!)

Wanted to clarify a couple of things mentioned about PAXG so that the community can make an informed decision:

-

Redemption: PAXG can be redeemed directly for USD at spot price, for unallocated gold or gold bars (430oz). We do also offer smaller physical gold redemptions via partners for denominations as small as 1 gram. Believe partners now deliver to UK, US and Canada.

-

Regarding lack of details using the “Allocation Report” tool - it’s stated that the tool does not work for custodial exchanges/wallets (tool limitation rather than lack of gold backing). Paxos does publish monthly attestation reports audited by Withum which certifies the requisite backing.

Disclaimer: I work for Paxos but not specifically the PAXG product so really just contributing as a community member. Love what the Curve team is doing!

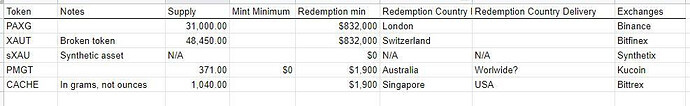

I don’t know what your Market Cap is. I’m just reporting what I’m seeing on the major reporting sites. And what I’m seeing right now is this:

Market Cap 24h vol

CoinGecko: 2,067,612 99,359

CoinMktCap: 424,409 106,099

Nomics: unknown 100,689

Also, I don’t know much about gold or tokenized gold. And so it might very well be that market cap doesn’t matter. Maybe trading volume doesn’t matter either. Just curious, what does matter? What should we be looking for?

More importantly, why is it worthwhile to host this tiny market? Let’s say Curve doubles the market, and that 100k/day of trading volume goes to 200k. And at 0.04% fees, that means that even then total trading fees would be $80 dollars a day, or $29k/year.

Does that get anyone excited? Can someone please explain how we make money here?

(from other topic)

So @cache.gold is OK for its token to be traded through a proxy token representing ownership of an underlying CGT. Isn’t it a risk for @cache.gold that this proxy token becomes the main way to transfer the underlying token (and thus would make you missing out the transfer fees in other contexts) ?

I am wondering the same thing for PAXG (and other physical gold backed tokens). Maybe a common/standard wrapping solution could be found.

It would be interesting to have some opinion about this.

My main concern is decoupling a pool contract from a wrapping contract. I am not very comfortable with making pools “fees-aware” (for historical reasons I guess).

EDIT :

As far as which token to include in the pool, I won’t vote PMGT and UpXau because they both seem related to Perth Mint, which seems a bit shady from the sound of some articles :

Maybe it won’t make their gold less valuable or less backed (yet ?), but not sure I want to take the unethical risk anyways. No-go for me.

I voted for PaxG, sXau and Cache Gold.

Has anyone heard of VeraOne ?

Hey Jon,

The traditional Gold markets for structural reasons have very tough times ahead and are riddled with price manipulation. If you search the internet for analysis of the Comex and Loco London, even just the GLD, it is not a situation that increases trust in the Gold price as it is set.

Gold is, for much the same reasons that Bitcoin is, bound to be very relevant in case of higher inflation caused by central banks. Gold is the original uninflatable hard money and has been for hundreds of years. We’ll see interest in Gold increasing strongly in the next years as more and more currencies around the world will struggle and people are looking for safety.

A fresh, scalable and sustainable infrastructure to set a trustworthy Gold price is going to be a worth while investment in the next years. The structural benefits of DeFi have to play a key role in this! Personally I’m excited to create a hard-money ratio token that leverages the higher growth potential of BTC with the lower volatility of Gold.

My two cents

Supply is currently approximately 1,102z. Currently we can ship to US and Singapore. Many more countries will be added soon, COVID has unfortunately disrupted shipping. Almost anyone can redeem for USD, there are just a few countries that are restricted due to sanctions lists. Anyone can take delivery in person in Singapore as long as they are not on a sanctions list.

Redemption: PAXG can be redeemed directly for USD at spot price, for unallocated gold or gold bars (430oz). We do also offer smaller physical gold redemptions via partners for denominations as small as 1 gram. Believe partners now deliver to UK, US and Canada.

Agreed, however the fees to redeem to USD start at 1% and only scale down to 0.15% at redemptions >= $400K. You are also limited to a single, centralized bidder and you cannot take delivery of your gold and go elsewhere if you don’t like the bid unless you hold >=430 troy ounces and in that case you will almost certainly be left with extra tokens to dispose of.

The smaller redemptions through Alpha Bullion have huge fees - 25% for gold eagles, 8.2% for 1 oz bars and 4.4% for a 1 kg bars. You can redeem a 100g or 1 kg bar with CGT for 0.15% or less than 0.50% shipped to a US or Singapore address (many more countries will be added after COVID restrictions are lifted).

Regarding lack of details using the “Allocation Report” tool - it’s stated that the tool does not work for custodial exchanges/wallets (tool limitation rather than lack of gold backing). Paxos does publish monthly attestation reports audited by Withum which certifies the requisite backing.

Where is that stated? What possible reason could there be to not provide full list of bars? Without such a list, how could anyone determine if all the tokens are actually fully backed? Why is the circulating supply reported as 100.00%?

The linked attestation report is already more than one month outdated. It also doesn’t provide a full list bars with weights and purity and it only attests to 25,889.153 troy ounces while the current supply is apparently 30,691 troy ounces. An audit or “attestation report” only attests to the existence of bars as of a specific point in time while the CACHE Explorer provides near real-time data on all of the bars backing CACHE. We respectfully disagree that this “Attestation Report” provides appropriate transparency for an asset-backed token. Furthermore, we also believe that Coin Market Cap doesn’t compare “apples to apples” by reporting 100.00% of total PAXG tokens as “circulating supply” but significantly less for XAUT, CGT and PMGT (DGX is reported as slightly less) and wonder if this is due to the fact that Coin Market Cap is owned by Binance and PAXG was recently listed on Binance.

Furthermore, it sounds like the attestation report gives no guarantees as to whether or not the gold is otherwise encumbered (in addition to the tokens) “In addition, we have not performed any procedures or provided any level of assurance on the financial or non-financial activity of the Gold Reserve on dates or times other than the Report Date and Time noted within this report.” but perhaps we’ve misread that. What is clear is that that attestation report is only valid as of the date and time of the report.

Current circulating supply of CACHE Gold is always reported on our home page, token supply page and in the CACHE Explorer. We also have a supply API available upon request. Anyone can audit the supply of CACHE Gold and its backing at any time with publicly available data.

Also, I don’t know much about gold or tokenized gold. And so it might very well be that market cap doesn’t matter. Maybe trading volume doesn’t matter either. Just curious, what does matter? What should we be looking for?

We’d argue that redeemability and transparency are the most important factors. There is no question that currently gold tokens in general lack liquidity and demand, however we believe that Curve (and other DeFi platforms) can help change this. Gold is a key asset for digital asset investors looking for a less volatile safe haven asset that is not inflationary. CACHE Gold can expand its supply to meet demand very easily because of its partnerships with vaults and liquidity providers which currently add billions of dollars in liquidity annually to precious metals markets.

More importantly, why is it worthwhile to host this tiny market? Let’s say Curve doubles the market, and that 100k/day of trading volume goes to 200k. And at 0.04% fees, that means that even then total trading fees would be $80 dollars a day, or $29k/year.

Does that get anyone excited? Can someone please explain how we make money here?

The gold market is much bigger than all the assets listed on Coin Market Cap combined. Above ground gold has a current value of approximately $12.3 trillion vs. $325 billion (according to Coin Market Cap). The potential for asset backed tokens, including but not limited to gold, is huge. Gold is a good place to start.

It isn’t up to us what token holders choose to do with their tokens. CACHE Gold tokens are open, public tokens and cannot be blacklisted, frozen or confiscated. If a token holder wants to create a proxy token that is their choice and their right. This is the reason we have a storage fee and we wonder what will happen to other asset-backed tokens if token holders circumvent transfer fees.

PAX GOLD is the only one with a TRUST that ensures the ownership of physical gold to token owners.

This is very important for safety.

Don’t think it’s the only one and minimum redemption figure is a bit silly.

I wonder how many people actually redeemed $800k worth of gold with Pax

Where is the complete list of their bars and why do they have so many problems with their Allocation Report? It seems like a matter “trust” that the bars are all there.

Thanks for the thoughtful response.

The question in my mind remains, why is this small market worth the complexity and distraction right now? Curve is less than a year old and CRV is less than a month old. Should we focus on bigger and higher priorities?

I’m also very concerned that Curve is becoming a place that token sponsors can directly lobby the community for the listing of their coins.

I’d also like to hear from other people in this group as to why this is necessary, appropriate, and lucrative.

Hi @Jon,

Thanks also for your thoughtful comments and questions.

Obviously we’re biased!

However, everything has to start somewhere. It wasn’t long ago that Curve was at zero, and not so long before that (in the grand scheme of things) when bitcoin was trading for pennies.

Curve has a unique opportunity to be a first mover in creating decentralized liquidity between fiat denominated stablecoins and precious metals. To us, this seems like an obvious step forward in the DeFi world. And gold is just one of a plethora of potential real world assets that could back stablecoins.

The current market price of all above ground gold is over $12 trillion as compared to less than $400 billion for all digital assets currently tracked by Coin Market Cap.

It’s up to community stake holders to determine whether or not this is a wise use of resources but we think it’s a great opportunity. It seems virtually inevitable that asset-backed tokens will become a major market eventually and as of today it’s a market that is still largely untapped. We’d be honored to work together with Curve as early adopters in this new marketplace.

Just for the record I didn’t even know what Cache Gold was when we started the process of discussing a gold pool.

You can see the original discussion there [Discussion]Tokenised Gold Pool

The transparency of CACHE and the ability to see what I own along with being able to redeem for physical precious metals at multiple locations around the world is very important to me, especially in the current climate of how finances are being handled in countries around the world. I believe Cache’s model and technology along with scalability make it the superior choice.

I like PMGT (created on behalf of the Perth Mint)the corresponding gold asset is guaranteed by the Government of Western Australia and each token is backed 1:1. It seems to be the only guarantee of its kind in the world in the physical gold sector - this makes PMGT a low risk inclusion in regards to counter-party delivery risk.

Downsides

- only one vault location (ships from Perth worldwide pending COVID)

+/- minting fee to convert to physical (1 oz $20 fee, 5 oz $55 etc)

About liquidity and market caps of the tokens:

Why does it matter? We’re talking about stablecoins here, so the liquidity of the tokens themselves don’t really matter as they’ll have no effect on the price. They’ll all follow the price of Gold.

Instead what really matters is the solidity and trustworthiness of their backing.

About sXAU:

Its a derivative, so the mechanisms defining it are transparent. Its backed by SNX, its price will always follow the exact gold price set by whatever oracle they have on the Synthetix exchange, and the liquidity is independent of the current circulating supply of sXAU tokens because of how synthetics work.

About PAXG:

It can be redeemed for 1oz American Eagles or 1oz generic bars through one of their partners merchants available in the US and Canada.

https://alphabullion.com/redeem/

(Never tried it personally)

It’s based in the New York state and thus regulated by the NYDFS.

However like most gold tokens (except PGMT) there’s no clear and direct chain of backing between you the token holder and the actual gold.

Its pure trust in the company issuing it, but this one being based in the US and offering ways to redeem for physical gold are good signs.

About PGMT:

- So we have a company called InfiniGold in charge of managing these digital certificates that are insured by the National mint through a service called GoldPass.

- The token itself is a marginal and recent sub-service of their GoldPass ecosystem.

- To interact with GoldPasses and redeem or buy them (which you can do directly independently of the crypto token) you do this through Infinigold’s services (they have an app) and you need to be KYC and its not available from all countries.

- This company InfiniGold is not directly the Perthmint but seems to only exist in regards to it as a kind of subsidiary and is referred to directly on the Perthmint website as well. Its the company in charge of managing their GoldPass service of digital certificates.

That’s my understanding of it so far.

What makes PGMT for me the best gold stablecoin is that despite this it still seems to be the coin with the least intermediaries and the least parties to trust.

It has the simpliest and most transparent flow from user token to gold insured beyond reasonnable doubt (perthmint certificates).

Theres only one step requiring trust which is the swapping of token to the certificate. Once you have that, you have a claim backed by the Australian government.

So it makes it the only token when you as a token owner can ‘see’ what is backing the token by redeeming the actual legal certificate associated to it yourself.

So I’m in favor of these 3 tokens. PGMT, PAGX, sXAU.

It can be redeemed for 1oz American Eagles or 1oz generic bars through one of their partners merchants available in the US and Canada.

https://alphabullion.com/redeem/

That’s true but the premiums are very high. 8.30% for 1 oz and 4.48% for 1kg. It also seems as though there may be shipping fees on top of the premiums as well.

"WHAT ARE THE FEES ASSOCIATED WITH ALPHA BULLION TRANSACTIONS?

We try to avoid charging any additional fees. However, you may incur shipping fees, taxes, and duties. The rates may vary depending on your location."

Shipping seems to be only the US and Canada for now.

"DO YOU SHIP INTERNATIONALLY?

Yes! We are proud to announce that we do ship outside of the US. However, we are currently limited to shipping to Canada. Please note that we are constantly expanding the list of countries we can ship to. We will keep you updated on our site as we expand the regions we serve."

It still isn’t clear why PAXG doesn’t list all the bars in their allocation report.

As for PMGT, while the government guarantee is attractive, it seems that it’s only the Gold Pass certificates that are guaranteed, not the tokens so token holders may not be covered by the guarantee until the point at which they redeem their tokens for Gold Pass certificates.

The other issue is that you are beholden to a single entity in a single location, whatever their terms are and their willingness to redeem. Shipping could also be expensive and impractical from Australia depending on where the redeemer is based. You are also depending on them having immediate availability of whatever bar type you would like to receive. It is not the same as having specific allocated bars backing the token in a 1:1 ratio. We tried to sign up for redemption from four different countries to test it out back in May and none of them were accepted for redemption. Perhaps there is a list somewhere that clarifies which countries can redeem?

Great summary @Ronchiporc!

PMGT:

- I think it is also noteworthy that they do not charge any management or storage fees, so you are not loosing any gold while it is locked up. They also do not charge transfer fees.

- It is the only token with a true gold player behind it. The Perth Mint does not need to create additional business models - their business is to refine, trade and distribute gold; you get it directly from the source.

- As you described: the fact that it is linked to GoldPass means you can also liquidate a position (or buy more gold) when gas prices go through the roof and crypto markets go crazy

PAXG:

- I think this is clearly the most liquid gold token around

In my view those two should definitely be part of the pool!